If your organization has been searching for a way to more efficiently and effectively perform adverse media screening, then you’ve likely read about the impact AI is having on adverse media screening and other areas of financial crime compliance. And the stories are true…at least, the stories about WorkFusion. We are applying our years of expertise in the financial industry, AI, and other intelligent automation technologies and tactics to deliver high levels of process automation in many areas of FinCrime operations, from anti-money laundering (AML) and sanctions compliance, to Know Your Customer (KYC & pKYC) and fraud detection.

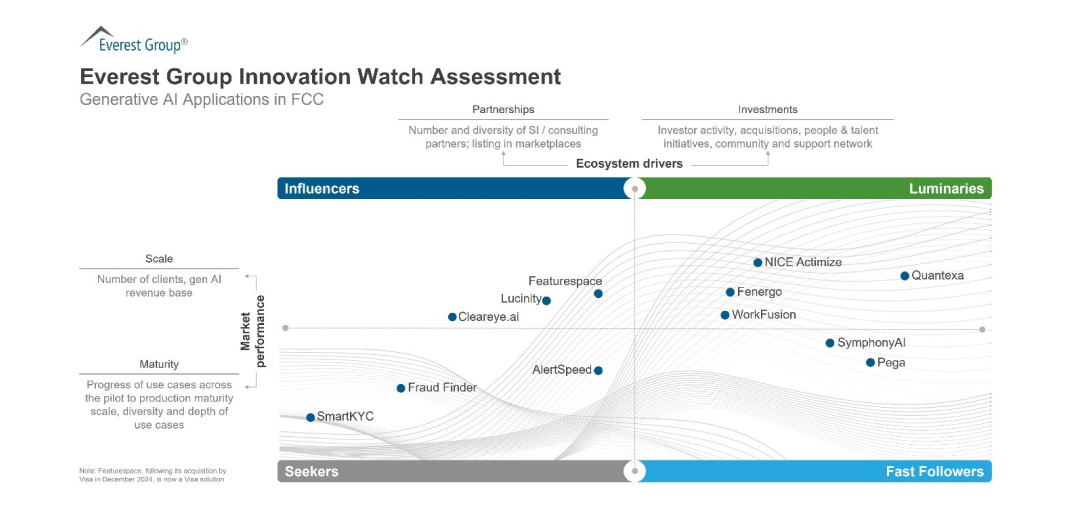

A recent proof point for how WorkFusion’s AI agents for financial crime compliance are delivering real-world results for customers and partners can be understood by reading Everest Group’s Innovation Watch Assessment for Generative AI Applications in Financial Crime Compliance (FCC). In the report, Everest Group positions WorkFusion as a “Luminary.” Luminaries are defined by Everest Group in the report as vendors that possess the maturity and scale to deliver solid market performance and, simultaneously, have the partnerships and investments in place as ecosystem drivers.

In arriving at their “Luminary” designation for WorkFusion, Everest focused their evaluation of WorkFusion on the AI Agent named Evan. Evan performs adverse media screening alert reviews on behalf of Level 1 analysts. Everest noted, “…Evan reflects a targeted and operationally grounded use of generative AI in adverse media monitoring. By combining large language models with machine learning and rule-based automation, Evan enhances efficiency in text analysis, entity matching, and data extraction, which are the key tasks in compliance workflows.”

In fact, Evan’s large language model (LLM) capabilities include pre-engineered prompts as an alternative to a machine learning ensemble for data extraction and classification. That delivers value in three main ways:

- Customers can increase Evan’s automation rates from the typical 60-80% to over 90%.

- Evan more easily collects key data elements from individual articles while adhering to backend reconciliation controls

- Pre-engineered prompts and pre-defined reconciliations help to avoid the need for self-builds.

In the end, Evan automatically finds and reads articles, assesses the adverse context of keywords as they relate to the subject of the search, spots risk factors like mentions of rogue nations or politically exposed persons (PEPs), and prioritizes the relevance of each article. In doing all this, Evan reduces a 20-minute human process down to just 2 minutes.

Banks and other FIs highly value how Evan helps them cut through the request queue with ease, then enables even stronger results and a detailed audit trail to ensure that regulators can trust and verify that the entire process is sound and that the results are valid.

How an AI Agent for adverse media screening alert review actually works

To understand that, take a look at the below image of a typical adverse media screening & alert review process when a company uses Evan.

As the above image shows, Evan can provide an entirely automated process for adverse media monitoring and reporting—made up of the following steps:

Steps 1 & 2: The compliance team’s existing tools collect the names of people and/or entities targeted for adverse media screening and execute the initial search.

Step 3 (inside the shaded box): Evan retrieves all potential adverse media results (articles, reports, data, etc.) from any of the leading tools (e.g. LSEG, Dow Jones, Thomson Reuters, and Google).

Step 4: Evan reviews the retrieved articles/data/etc., then applies both pre-trained insights and AI-based decisioning. At the end of this step, Evan also writes the rationale behind each decision ‘he’ makes and provides detailed justification in auditable form.

Step 5: Evan dispositions articles and other information pieces based on identifying mismatches for entity and people names, location, focus of the article, level of materiality, etc.

Step 6: After eliminating the majority of content that fails to indicate relevant issues, Evan prioritizes for human review (typically for a Level 1 analyst) all the information pieces/articles/news that could possibly match the search target and be material.

Step 7: Pulled into the process via automatic human-in-the-loop (HITL) functionality, the human analyst makes final decisions on the escalated pieces from Evan within the WorkFusion UI or WorkFusion WorkSpace.

Step 8: Once the human analyst completes their work, Evan produces a final report and delivers it to the location desired by the compliance team. This can be a case management system, an email to designated individuals—whatever place(s) the compliance leaders dictate.

Because Evan is prebuilt with deep industry and prior FinCrime knowledge, he can fully investigate an entity with as little information as just a name.

Why Evan performs adverse media alert reviews so effectively

First, it’s not just Evan. In fact, WorkFusion AI Agents incorporate what WorkFusion has learned about building AI models and automations that help improve banking and financial services operations over the past 10+ years. Our depth of industry and technology knowledge are helping organizations take a different approach to managing resources and talent as we create pragmatic AI- and automation-based agents that orchestrate entire jobs (or processes). In this case of Evan, the job is adverse media screening and alerts review to support KYC efforts.

But there are several more AI Agents that, like Evan, can turn once-manual processes into highly automated ones. For example, Evelyn is the WorkFusion AI Agent for Name Sanctions and PEP Screening Alert Review. Evelyn can complete L1/L2 adjudication of name sanctions and PEP watchlist alerts. Like Evan, Evelyn delivers an immediate and tangible impact by automating many of the time-consuming, error-prone tasks related to sanctions screening alert review. And just like Evan, Evelyn does the following:

- Integrates with sanctions screening tools to accurately and rapidly review and disposition false positive alerts

- Identifies potential risks faster and with greater accuracy

- Begins work as soon as an alert is generated

- Provides full auditability into each action she performs

- Supports each decision with supplemental information and justification to enhance reliability

To see which financial crime compliance job roles and processes are being addressed by WorkFusion AI Agents, meet the entire team here.