Company recognized for its combined maturity, scale, investments, and partnerships in GenAI for Financial Crime Compliance

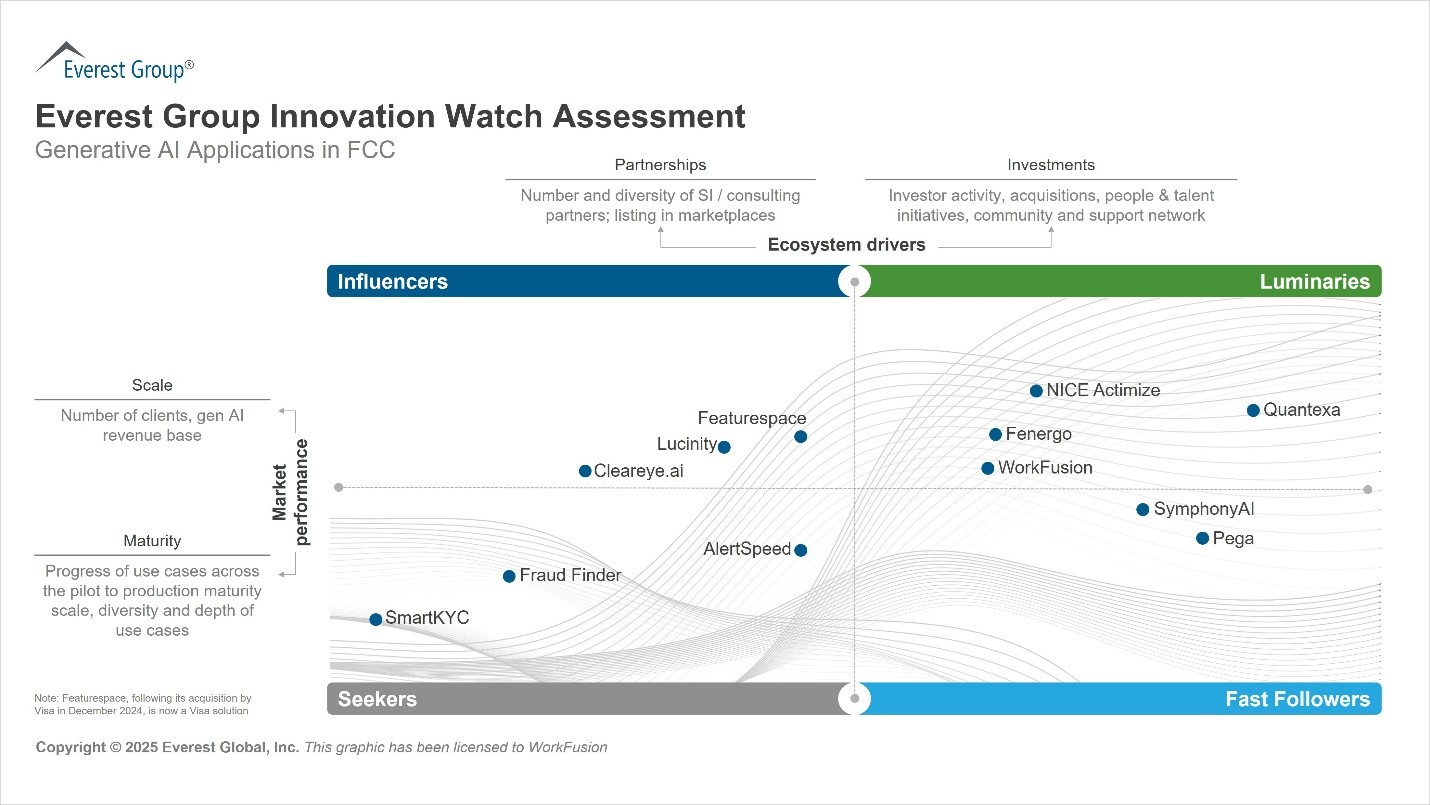

NEW YORK, June 11, 2025 —WorkFusion, a pioneer in AI agents for financial crime compliance (FCC), today announced that it has been named a Luminary in Everest Group’s Innovation Watch Assessment for Generative AI Applications in Financial Crime Compliance (FCC). In order to arrive at this prestigious position, Everest Group evaluated WorkFusion’s Evan, an AI Agent for adverse media monitoring. Evan orchestrates GenAI and a machine learning ensemble to automatically analyze news articles and other content, facilitate human-in-the-loop workflows, submit audit-ready reports for streamlined compliance and can reach automation rates of up to 93 percent.

“WorkFusion’s deployment of Evan reflects a targeted and operationally grounded use of generative AI in adverse media monitoring. By combining large language models with machine learning and rule-based automation, Evan enhances efficiency in text analysis, entity matching, and data extraction, which are the key tasks in compliance workflows,” says Dheeraj Maken, Practice Director at Everest Group. “The solution’s integration of a human-in-the-loop model ensures auditability and accuracy, addressing enterprise-grade requirements. These features make WorkFusion a Luminary in Everest Group’s Innovation Watch Assessment.”

Evan is a pre-built AI Agent that integrates with news sources and existing case management tools to reduce the negative news alert noise. Financial crime compliance operations teams that use Evan significantly reduce the amount of time spent by human analysts on manual reviews for adverse media screening. Evan automatically finds and reads articles, assesses the adverse context of keywords as they relate to the subject of the search, spots risk factors like mentions of rogue nations or politically exposed persons (PEPs), and prioritizes the relevance of each article. The AI Agent optimizes a 20-minute human process down to 2 minutes, helping companies cut through the request queue while assisting the team with stronger results and a detailed audit trail.

WorkFusion CEO Adam Famularo said, “We appreciate Everest Group’s evaluation of how our financial crime compliance solutions are delivering real results to our customers. GenAI isn’t right for every customer or every use case, however, our AI Agents are demonstrating how GenAI can be elevated from a general tool to one that has a real impact on business operations, particularly for a regulated industry as risk-averse as financial services. GenAI is continuing to advance the development and execution of processes. It’s not just about smarter AI, but making it truly useful, trustworthy, and scalable for all business functions.”

About WorkFusion

WorkFusion is a pioneer in AI agents for financial crime compliance (FCC). Its AI Agents are purpose-built workers that augment financial crime compliance operations teams in Level 1 analyst functions for anti-money laundering (AML), adverse media monitoring, sanctions screening alert review, Know Your Customer (KYC), and transaction monitoring investigations (TM). WorkFusion’s AI solutions are used at 9 of the top 20 US banks and leading financial institutions around the globe to mitigate risk, solve talent challenges, increase workforce capacity, save money, enhance employee and customer experience, and improve compliance posture. For more information visit workfusion.com.