When it comes to tackling the increasingly complex problems of 21st-century banking — from sanctions and KYC to employee burnout and labor shortages — who better to partner with than someone who’s been in your shoes? Before our Global Head of Client Lifecycle Management, Daniel Hazel, joined WorkFusion, he helped revamp multinational banks’ FinCrime programs. In other words, he understands first-hand the pain points that keep our customers up at night.

We sat down with Daniel to talk about his former roles, how he leverages his industry intel today at WorkFusion, and his mission to solve the toughest problems in banking not only for our customers, but the industry at large. This interview has been edited for length and clarity.

WorkFusion: So Daniel, in a nutshell, what do you do at WorkFusion?

Daniel Hazel: I’m WorkFusion’s Global Head of Client Lifecycle Management, and I think I have the best job at WorkFusion. I get to work with our customer stakeholders and prospective stakeholders to understand what they’re trying to achieve not just today, but next week, next month, next year, even after. Then we figure out how WorkFusion can help them achieve those goals. Because ultimately our customers know what they want to achieve, why they want to achieve it, but the how of it isn’t something that they’re fully aware of. That’s where I come in.

WF: Can you tell us a little bit about your past experience in banking and finance?

DH: The way I view it is I used to be on the other side of the fence. At WorkFusion now, we work with banks and people in relatively senior positions in banking, and I used to be in that position before. I was a consultant at EY and a consultant at a company called First Derivatives for just over 10 years. We worked with a lot of multinational banks on their FinCrime program, and I held senior positions in those FinCrime programs. We were looking to do large-scale remediation of customer accounts from old KYC systems to new KYC systems, running sanctions screening teams of 20 or 30 people, and renovating financial crime programs. I did that for almost 11 years, and it was really rewarding. I really enjoyed the job and the space.

Ultimately, I got a bit frustrated because as a senior manager in a consulting firm, I was going from customer to customer. We would solve something, deliver large-scale change, and then we moved to another bank. It’s like starting from ground zero. I wanted industry change, not just bank change. So I thought for a long time: The problems they had at bank A, bank B, and bank C, how can I solve those for the industry rather than just solving them specifically in each different bank? And that’s where I am today.

WF: Can you elaborate on your previous roles and pain points? Were they the very same roles and pain points as those of our customers?

DH: I think to answer that question properly, you need to understand what it is our Digital Workers are solving for. We’re looking to help banks reimagine the way their organizations can be built for today and for the future. Where instead of just having a human workforce doing this overwhelming amount of work, you can have solely Digital Workers or even a hybrid workforce of people and Digital Workers.

When I was on the bank side, I led projects and large teams, 40 or 50 people, where we were carrying out work that one of our Digital Workers can do. For instance, Darryl, our customer due diligence analyst, can do a lot of the tasks contained in a customer onboarding or a customer refresh that would have been done by teams of 40 to 50 people.

As for the pain points I had when I was there, I found it really difficult to retain talent because just the nature of the work, right? It can become quite monotonous and repetitive. It’s the nature of banking: you get really smart, talented individuals who just aren’t intellectually stimulated doing that work.

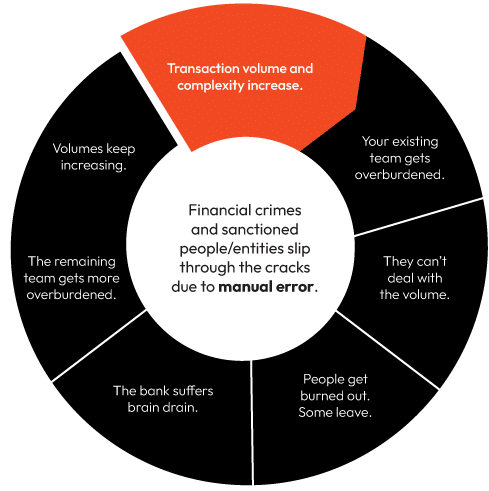

And then on top of that, because the work is so repetitive, it leads to a lot of mistakes. Because you’re reviewing the same thing day in and day out, your eyes can glaze over a bit. You would be surprised at the amount of elementary mistakes and inconsistent reviews that can take place within a team. There’s a lot of downstream effects. There’s a re-work on that case, where you’re actually doubling the amount of work. And in the background while all of this is going on, a customer isn’t good to trade, so they can’t use the products they want with the bank until that review is completed. So it’s kind of like a snake eating its own tail: Employees end up doing more work because inconsistent mistakes lead to more work. But then at the same time, your customer is getting really annoyed because they’re not able to do what they want to do with the bank.

Our Digital Workers can help there in a couple ways: Number one, if I was in that space today, I wouldn’t have to “hire” talent because Digital Workers work 24 hours a day, 365 days a year, and they’re not going to leave. So that whole talent part isn’t an issue any longer. The next thing is they’re always consistent in their reviews and decisions, so there’s no difference in quality on a Monday morning versus a Friday evening. As a leader, it means that you can have confidence that you’re getting the same level of quality today as in six months — if not better. Digital Workers learn, and they don’t forget. I’ve been in banking for 12 years now and I’ve probably forgotten more than I’ll ever learn, but Digital Workers don’t have that problem.

When I speak to customers, they ask me, Daniel, what you’re showing us here, it looks like the Holy Grail. It looks like exactly what we’re looking for. But can you level set with me? Do the Digital Workers actually deliver the benefit that you’re saying they do? I’m extremely proud to say yes. All of our Digital Workers are live in a global bank working with production data, delivering production results. They’re not concepts, they’re not ideas, but they’re learning on the job. That’s a world away from having to work with the customer to build the Digital Workers themselves, build machine learning models, or build the workflow. The same way that a bank can hire somebody from another bank, they can just “hire” our Digital Worker and they’re immediately productive. That makes a big difference.

WF: How do you think you and your previous teams you managed would have been affected if you had had WorkFusion and our Digital Workers on your side?

DH: I think ultimately what it would have meant for my teams and, in fact, any teams that we’re working with today, is they’ll get a lot more job satisfaction. For the bank, that means that they’ll be able to retain their employees a lot more easily. Digital Workers take care of a lot of the busy work in an analyst’s day-to-day, and help focus the analyst’s attention on what really matters: what will generate revenue for the bank, what requires nuance to review. The status quo in some organizations for a banking analyst is they think I don’t know what to look at. I don’t know how to prioritize my time. This is monotonous and I want to pull my hair out. In the new world, WorkFusion and all of our Digital Workers do the level 1 review, and it helps move teams from being analysts to becoming investigators — risk investigators, sanctions investigators, AML investigators…I probably would still be in banking if I had a team of Digital Workers, because it would make my life a lot easier. The Digital Worker would flag the things I need to review; it would do that for my whole team.

Our prospects, customers, some of my close friends who are still in the banking sector — they help me keep my finger on the pulse so I know what is going to provide transformative change with the banks, and then work with our Product team to deliver on that vision.

WF: That’s a great segue to my next question. What motivated you to join WorkFusion? Did your past experience in banking lead you to WorkFusion in a direct sense?

DH: Yes, it did. I was frustrated with the cyclical nature of how banks work. To me it was a broken wheel. What’s the definition of madness? It’s doing the same thing day in, day out, and expecting different results. I went from bank A to bank B to bank C to bank D. And although from bank A to bank D, there was eight years difference, we were still doing the same thing and expecting different results. I just couldn’t understand why everybody was being reactive to problems, behind the 8 ball, reacting to changes in the market, rather than trying to be proactive. Redesigning the way we work and do business, redesigning the way compliance can be seen as a business enabler rather than a business restrictor. I was looking for somewhere that can help accelerate that change; or, for people who go into compliance, AML, or KYC these days, how to help them love their job. That’s how I came across WorkFusion.

Moving the world to more meaningful work resonated with me straight away. I’ve always been somewhat obsessed with time and making valuable use of one’s time. And at its most base level, that’s what WorkFusion does. It gives time back to people who just don’t have it. We’re redesigning the way they work so that they can focus on more valuable things, so their time can be directed into something that yields more benefit for them. For me it was a match made in heaven. I hope that because of the work we do today, that the Daniels who are in banking right now can leverage WorkFusion to really supercharge their work.

WF: Why and how are you specifically helping to solve the problems that you yourself used to face in your former role?

DH: In two ways. Again, I have a great job at WorkFusion — I get to work with our customers on understanding what they’re looking to solve for today, and what their objectives are for the future. So it’s not only problem-solving, but it’s building something strategic for the company. I take those learnings and I help our Product team build it. That means our Product and Engineering teams design a product that is fit for the market — that the market actually wants, needs, and can get tangible benefit from — versus building a product we think they need.

So it’s about that iterative feedback to our team. Our prospects, customers, some of my close friends who are still in the banking sector — they help me keep my finger on the pulse so I know what is going to provide transformative change with the banks, and then work with our Product team to deliver on that vision.

WF: You’re in this unique position to directly understand our customers’ pain points. Are there any stories of when you and a customer were particularly able to relate and connect due to your shared experience?

DH: A current customer that has deployed Digital Workers is actually where I began my career as a consultant over 10 years ago. I was intimately aware of the processes they have, and the problems they were looking to solve. And obviously, I was intimately aware of what WorkFusion can do. For me, that created an instant bond. They knew me and my work, so they knew that I’d only be with a company that could deliver upon what it says and has integrity.

Similarly, around the time of the start of the Ukraine War this year, there was a customer in Germany who found it really difficult to retain staff at that time. Again, I could instantly relate because when I used to lead teams of people, it is indeed difficult to retain people in these operational analyst or banking analyst roles, because sometimes they outgrow it or lose motivation for it. So I could really understand that problem and the frustrations they were dealing with.

I could help them understand how a Digital Worker can alleviate those stresses to a certain degree; how we can remove the stresses from your existing team, but also remove the stress from the manager to have to hire people.

WF: To close, I’d like to broaden out a little bit. What do you think is the biggest problem that WorkFusion is solving for banking today? And looking ahead a couple years?

DH: We are helping banks build organizations for the future. What I see at banks is they’re trying to solve problems today with tools we had 20 years ago. Whereas WorkFusion is helping banks with today’s tools to solve problems that will come up in 20 years. So it’s really shifting that tactical level of problem-solving from I need to solve for something in sanctions to How do I really redesign my compliance function to take advantage of Digital Workers and build for the future?

Read the first installment of the “From Finance to Fintech” Q&A series, featuring our Head of Financial Crimes Strategy, Grant Vickers, and stay tuned for upcoming installments.

To learn more about our AI-enabled Digital Workers, please schedule a demo.