Leaders of commercial and specialty insurance companies have long recognized the need to upgrade their underwriting and related business processes through automation. Business leaders know the cost-saving benefits, and tech leaders appreciate the boon to efficiency.

So, while these insurance companies recognize this need and move to automate their underwriting processes, they must also form a strategic roadmap to automation.

WorkFusion, Mindtree, and ISG have partnered with major insurance companies to automate critical processes such as new submission intake and document indexing/sorting via email. Recently, we gathered our insurance automation experts to share experience and expertise in an insightful webinar. For your convenience, we have summarized 5 top takeaways:

Commercial and specialty insurers are bound by legacy environments

Daniël Oostdam from ISG covered the most painful points for both commercial and specialty insurers: high technology costs, challenging customer experience, and complex and time-consuming operational processes. Intelligent Automation is the solution to these problems.

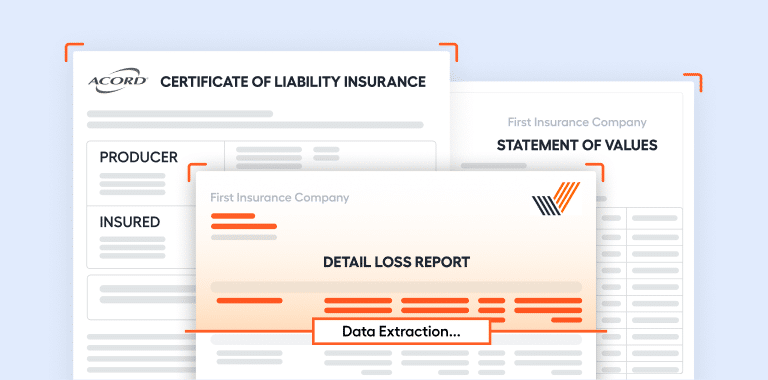

Insurers leverage Intelligent Automation as an augmentation layer to sit on top of legacy tools and automate end-to-end manual processes. This way, companies don’t have to engage in long and costly projects to modernize all their IT applications at once. With integration capabilities, insurers can automate the sorting of emails upstream and the input of structured data downstream. They also use AI-powered Intelligent Automation to automate the cognitive work happening in the middle, when analysts classify, extract, and reconcile data.

Commercial insurers can invest in IA programs, set the right targets

How can insurers measurably benefit from automation? Jim Davidson from Mindtree shared 5 real impacts of IA implementation for the typical New Submission Intake process:

- Reduce cost per transaction from ~$200 to ~$50

- Reduce handling time from ~25–30 minutes to ~5 minutes

- Manage 150+ submissions per day per underwriting assistant

- Eliminate errors and reduce underwriting leakage through a data-first process

- Consolidate key actions for underwriters in a single screen, while preserving legacy systems

A unified, integrated platform is essential

WorkFusion’s Adrien Cipel pointed out why an integrated platform is a must:

If you go on an Intelligent Automation journey by gluing different tools, systems, or software together — one OCR here, some RPA there, machine learning models, etc., all glued together with BPM, orchestration and analytics — then I don’t think it’s possible to achieve those benefits. You need an integrated platform to scale, go fast, and bring Intelligent Automation through in an industrial fashion versus piecemeal.

Then, Adrien Cipel demonstrated how to automate the New Submission Intake process with WorkFusion’s all-in-one platform, Intelligent Automation Cloud.

A strategic plan is key to automation success

Mindtree’s Deepa Thyagarajan provided a detailed outline of how insurance companies assemble an automation roadmap. According to Thyagarajan, they break the new business into more manageable pieces to be automated: first, the submission process, then technical premium calculation, and finally, the data area.

The next logical step after automating new business intake is to automate the underwriting process. Insurers typically use automation to correlate data from internal and external sources in order to get a unified view for their review or underwriting processes.

To make an automation roadmap, insurers typically classify their processes: Will this automation bring a tactical win or a strategy win? As they look into it, some automations might not bring immediate cost benefits, but they would lay a foundation for a successful automation journey.

WorkFusion integrates all capabilities required to scale Intelligent Automation

AI technology just sitting on the shelf isn’t going to deliver much value. To harness the power of AI, said Adrien Cipel, it must be embedded into the end-to-end process flow. That’s why you need platform capabilities like OCR, integration, trust and security, orchestration, and analytics.

“To deploy in your private cloud, or to deploy pre-built use cases, or to integrate with the data enrichment system, WorkFusion offers capabilities like a pre-built API, pre-built connectors into a Guidewire or Duck Creek system, and the ability to deploy on your private cloud. This is the ensemble of capabilities that you need if you’re serious about Intelligent Automation, and if you want to deploy at scale.”

For more valuable insights on how automation can transform insurance operations, watch the on-demand webinar recording.