A recent survey from the Association of Certified Anti-Money Laundering Specialists (ACAMS) reveals that “reducing false positives” is still a top concern for banks and other financial institutions (FIs). Yes, still.

The fact is, reducing false positives has been a top priority for anti-money laundering (AML) compliance leaders for decades. Just recently, a compliance leader echoed the old line of thinking on an AI-focused webinar for financial crime compliance stakeholders: “We should first talk about the effectiveness of screening – how many false hits are created…that’s the real risk point for a firm, from an operational perspective. The industry will keep putting money and effort toward resolving false positives.”

He is 100% correct. That is why it’s time to change how we think about, and handle, false positives.

Picture this: a new reality where you no longer even have to give much thought to false positives. Imagine the issue disappearing almost entirely for you and your FinCrime compliance team.

Seem too good to be true?

No doubt, you have put in a lot of effort (and budget) to manage false positives in recent years, maybe even stretching back to the early 2000s. Common tactics typically have included the following:

- Tuning screening and monitoring systems

- Expanding L1 analyst staff

- Hiring outside temporary labor during peak volume periods

- Outsourcing to domestic and foreign agencies

These were the right things to do…were. But now, technology has caught up and has surpassed these measures. This is where WorkFusion AI Agents for FinCrime compliance have changed the game, flipping the script on the false positives focus.

The elimination of ‘False Positive Fixation’

WorkFusion AI Agents automate your alert review procedures and present decisions to your team on every alert. Not only do our AI Agents completely decision (adjudicate) up to 90 percent of alerts generated by screening tools, people only need to make the final decision 10-20% of the time. And when people do, they have all the relevant information right in front of them, packaged nicely by the AI Agent.

In the end, we are not actually reducing false positives, we are investigating them for you in seconds.

Making the best decision every time

If you think about your best L1 analyst, who is it? It’s the person who is most reliable, follows your procedures to the letter, makes the wisest decisions, and documents decisions in a way that avoids negative scrutiny from auditors. Well, each WorkFusion AI Agent acts like a clone of your best L1 analyst. The only difference is that the AI Agent acts like 100 or 1,000 clones of the best analyst.

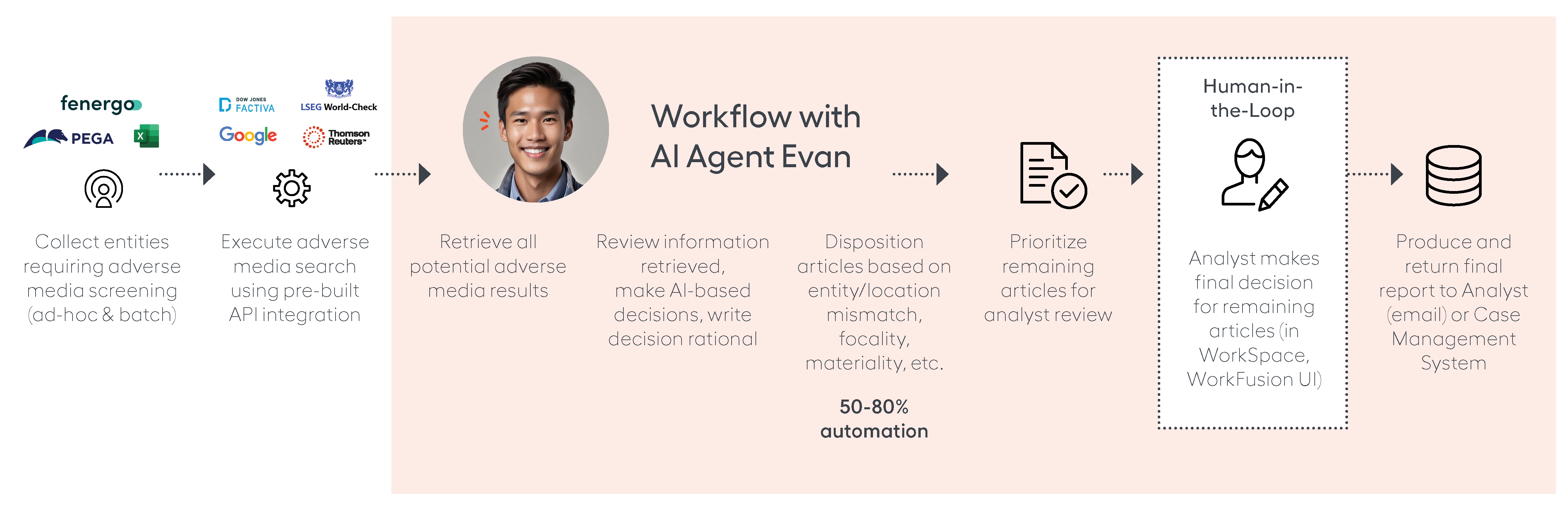

Take Evan, for example. Evan is WorkFusion’s AI Agent for adverse media monitoring. Evan can auto-adjudicate up to 95% of articles, act immediately on incoming requests, and make false positives vanish faster than a hundred clones of your best analyst. Let’s take a look at a typical Evan workflow for adverse media monitoring.

Keep in mind, Evan does not replace your screening or case management system. He works with it and with your people in an end-to-end automated process.

Per the above image, Evan takes information from your adverse media screening tool to review media information about your customers and potential customers. Evan then prioritizes news articles and other information based on relevance, demographic data, level of material significance, and other attributes.

Because Evan is prebuilt with deep industry and prior FinCrime knowledge, he can fully investigate an entity with as little information as just a name. After highlighting articles/information that indicate risk, he passes those cases to a human analyst to review. He also gives the analyst detailed justification in written, auditable form.

Not only does Evan dramatically reduce the workload, he effectively determines potential risk with far greater accuracy. And boom! – your organization no longer worries about missed data, false positives, backlogs, or quality. As a result, “False Positive Fixation” becomes a thing of the past for your compliance team. Better yet, you gain vast amounts of scale to do more or to focus your people on more strategic efforts.

To learn more, request a demo of Evan, Evelyn, and Tara – our AI Agents that make false positives irrelevant.