Recently, WorkFusion and our business partner PwC hosted a webinar on automating anti-money laundering (AML) processes, featuring Michael Lammie, a leader in PwC’s Financial Crimes Unit. During the webinar, we received many smart questions about automating AML. At WorkFusion, we work a lot with AML automation and banking automation in general, so we are happy to answer some of the most interesting questions from the webinar here.

1. How easy is it to implement a use case like automation of Negative News Adjudication?

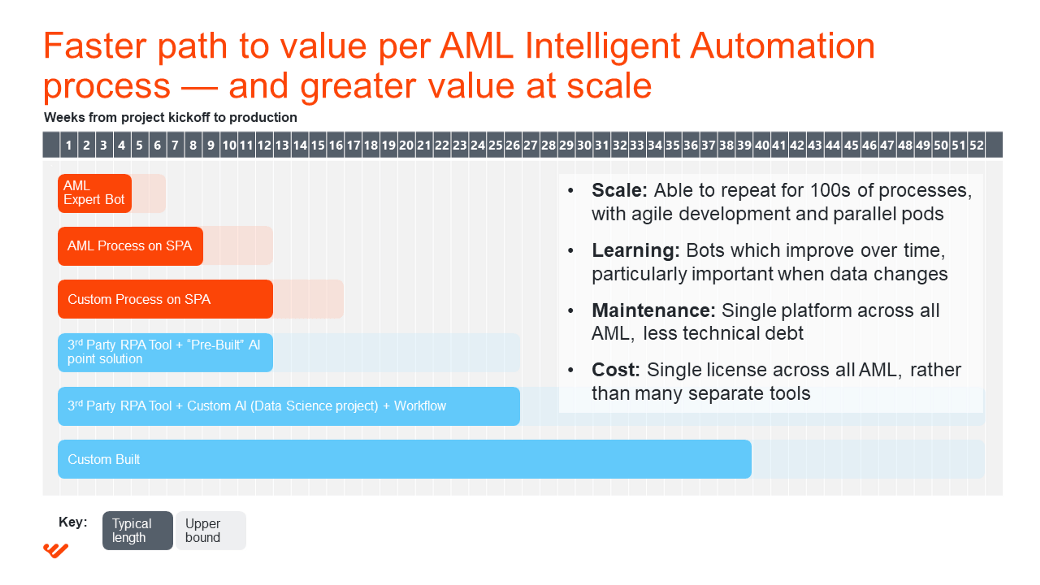

Automatization of an AML process like Negative News Adjudication can be implemented into production within four weeks.

WorkFusion’s AML pre-trained bots help automate complex processes quickly. This approach includes prebuilt workflows, quick connections to common systems and pre-trained but customizable bots. Implementation of the automated process can be compared to hiring a colleague from another bank, one who is already an expert on anti-money laundering legislation and comes with useful experience that speeds up how quickly they are productive. A more bespoke automated AML process will typically take 4 weeks to pilot and 4–8 more to put in production (8–12 weeks total).

2. How are differences from bank to bank addressed in AML processes?

WorkFusion’s Intelligent Automation Cloud is a flexible platform, so automatization of processes can be tailored to the requirements of a specific bank or financial institution.

Learning bots are trained by your staff, learning from real-world anti-money laundering cases. They can be trained in real time and on-premise (or to the cloud), which creates your own intellectual property. This contrasts with many AI tools, which are trained once, remotely and only in the cloud.

Customers can also easily add their own connections. Using rules (APIs or RPA), one can quickly integrate with proprietary systems and apps.

This customization can be easily implemented by the customer, with WorkFusion training available through our Automation Academy. Trusted business partners including PwC also have a ready-trained bench of WorkFusion experts to help guide and accelerate if needed, and WorkFusion can also provide support directly.

3. What other news sources can be used? What can we change?

WorkFusion can use any source of anti-money laundering news. Typical sources are pre-built, like Google News and Factiva. A customer can also add niche providers or their own internal data sources.

Moreover, WorkFusion works in 135 languages, and with non-Latin characters and alphabets, so global sources are encouraged.

Anything about the Negative News Search process can be changed. While the pre-built components help accelerate deployment and are based on best practices at the top 10 global banks, every step is open to customization to meet bespoke requirements.

4. How do I address all other AML use cases?

Anti–Money Laundering software robots are a core focus area of WorkFusion, with a dedicated product team, developing specific functionality.

The core WorkFusion product, Intelligent Automation Cloud, is a flexible and process-agnostic platform. It’s used across the world and in many industries to automate manual work (with customers ranging from Spotify to Canadian Tire).

This means that it isn’t limited to just those AML processes with pre-trained bots, but can be applied across AML, KYC, Financial Crimes, Compliance and Risk processes.

We have customers who have automated over 100 processes in AML and who continue to scale their AML automatization programs at pace.

5. How do Learning Bots work? How do they analyze news?

Think of an employee you hire to perform anti-money laundering investigations. There are skills you expect them to already possess on Day One, and there are skills you expect them to learn. For example, you expect them to be able to read the latest news on anti-money laundering and check for keywords. They may need additional training on how to judge different risk factors and summarize findings. Over time, as they work on more cases and receive guidance from their manager, they will become better at the job.

Similarly, WorkFusion comes with NLP capabilities — the bots can read the news and have a keyword dictionary. AI is then used to help the bot interpret the news, judge the different risk factors, make better decisions over time, and produce ever-better summaries of its findings.

The specific AI technology is supervised machine learning. The bot learns from people. Its effectiveness and speed are further supported by a cutting-edge AI technique called “weak supervision,” which reduces how much training is required, so the bot can learn faster.

6. How do we justify the use of AI to regulators?

Fortunately, these days, authorities are encouraging the use of “innovative approaches” in anti-money laundering regulation responses. U.S. federal banking agencies and the Financial Crimes Enforcement Network (FinCEN) issued a joint statement in December 2018, specifically welcoming Artificial Intelligence to “strengthen compliance approaches… enhance transaction monitoring system… [and]… maximize utilization of banks’ BSA/AML compliance resources.”

WorkFusion offers a range of capabilities to explain what AI is doing and how it is performing:

- Learning bots are supported with AutoQC, which allows people to dynamically review bots’ work, or, where appropriate, make the automated process fully attended or unattended

- For sensitive processes, this human-in-the-loop step allows for a “maker checker” model, where the final decision is always made by a person

- Learning bots are trained based on business logic and are easy to configure to use “white box” models

- Preventive controls, audit trails and AI-era security help keep the process automation compliant to anti-money laundering requirements

- Analytics through the end-to-end process make it easy to monitor the performance of both bots and staff, down to a decision/field level

Also published on Medium.