Many banking and financial services organizations, particularly in AML and Financial Crime compliance departments, are struggling to find employees, or the employees they have are overwhelmed by the amount of work that needs to get done. Automation sounds like a great idea, but the IT team or Automation COE may have already deployed automation that just isn’t getting the work done and may not be ready for months, or even years.

AI Agents are different from RPA-based automation tools. The Digital Workers are pre-programmed, pre-trained digital embodiments of the operations analysts needed to perform AML and sanctions compliance at financial institutions (FIs). They provide a blend of cognitive thinking, intelligent document processing (IDP), automation, and role-specific training—all operating in unison. They deliver the scalability, consistent quality, and speed necessary to eliminate sanctions alert and KYC backlogs. And because each Digital Worker can automate an entire role in AML/Sanctions/KYC compliance and immediately alleviate staffing challenges, they quickly place any FI into good standing with regulators while boosting operational efficiency.

Organizations that hire AI Agents have, typically, already gone down the path of attempting to either build their own in-house technological capability or to integrate multiple technologies (i.e. IDP, automation, bespoke data science, etc.) to mimic steps in their compliance processes. Yet, once they learn how easy it is to get started with an AI Agent that automates all the steps, they never look back.

Imagine getting a well-defined and proven compliance worker that is ready to perform on Day One following a rapid implementation, versus facing the slow ROI and risks associated with the scenarios of “build yourself” or “integrate multiple technologies.” It’s the difference between generating value in the short term, rather than waiting for technology to be ready in the long term.

With AI Agents delivering so much value right out of the box (or in SaaS form), one might be tempted to believe that they are challenging to acquire and set up. Yet, the opposite is true.

It’s quite simple to get started with one or multiple AI Agents—for four reasons:

- They correspond to the AML/Sanctions/KYC compliance job roles you’re trying to fill

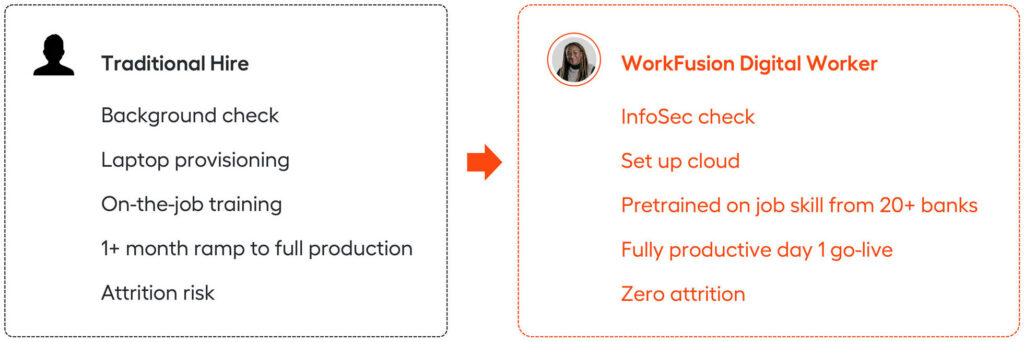

- You can “hire” them nearly the same way you hire a person

- They can perform their job role immediately

- They solve the problems that hiring more staff won’t solve

To demonstrate this, let’s examine the AI Agent that we call Tara.

Tara is the digital embodiment of a Transaction Screening Analyst. Tara is pre-trained as a top OFAC/AML expert that focuses on keeping transactions risk-free. “She” automatically monitors payment activity to ensure compliance, plus reviews and analyzes payment messages/cases.

Tara does the jobs you need to fill

Organizations that hire Tara can leverage her capabilities to fill many roles within payment operations, sanctions screening, and operations transactions services, including:

- Sanctions Analyst Level 1, Transactions Services: verifying transactions and documentation from a sanctions perspective.

- Sanctions Screening Level 2, Transaction Services: Cash & Trade Process Analyst 2.

- Wire Transfer Representative: Ensures wires meet compliance and policy guidelines, reviews OFAC hits, and works with compliance to resolve issues

You can hire Tara the same way you hire people

Tara, like all WorkFusion AI Agents, can be hired for the same cost as a single full-time employee (FTE). Yet, Tara can work 24x7x365 and never takes vacation or sick days. Here are the comparative steps FIs follow when hiring a full-time employee or Tara. They are strikingly similar.

A major difference when hiring an AI Agent like Tara is that you can scale Tara virtually infinitely. So, when your staffing need is for more than one FTE, the savings really begin to add up. After all, getting started with an AI Agent is priced equivalently to a single FTE. Once you need to scale to handle more volume, the AI Agent provides economies of scale around its cost, whereas a second FTE has fixed costs and must go through the entire hiring/provisioning/training process.

In addition, while Tara stays true to your team, many compliance teams suffer high rates of attrition. In a recent ESG-WorkFusion study of operations executives, Navigating the Great Resignation with Digital Workers, 87% said it’s harder to retain employees than 12 months earlier. Nearly 90% stated that it’s now harder to recruit employees than it was 12 months prior.

Tara can perform her job role immediately

Even when an FI’s compliance operations team can hire new FTEs, it takes an average of 5–7 months for the new hires to reach full productivity. By contrast, a new AI Agent takes only weeks to implement and reach full productivity.

Easy just got easier with the WorkFusion Digital Worker Starter Service

FIs vary greatly in their technology infrastructure strategies—from purely SaaS at neobanks, to on-premises at traditional banks. Whichever it is, WorkFusion now provides rapid-implementation starter services for either cloud SaaS/MS environments, cloud SaaS/MS needing customer connectors, on-premises/private cloud, or on-premises/private cloud needing custom connectors.

These starter services ease the adoption of your AI Agent via a fixed fee, pre-packaged offering designed to help you with the initial implementation, configuration, and knowledge transfer. They even include a scoped amount of professional services support over a fixed deployment timeline. For those requiring a custom connector, the package also includes custom integration work scoped to an input source and an output source.

Isn’t it time that you made your compliance operations easy? Request a demo today and see how easy it is to get started with your own AI-driven compliance professionals.