Customer satisfaction is a key differentiator for many companies today. It is especially important for banks and other financial institutions, as customer relations is a major pillar of their business. With stiff competition in the industry, customer expectations are higher than ever: They expect superb service, and if they don’t get it fast, they turn to another bank. So, it is not surprising that a seamless customer onboarding experience is an essential area of investment for many companies.

According to the white paper “A New Urgency: Cognitive Automation,” an average-sized financial institution can allocate as much as $50 million to onboarding, and large banks spend more than $500 million. However, customer onboarding times are increasing despite banks’ best efforts. A solution to these problems may lie in transforming customer onboarding with Intelligent Automation. But first, let’s see why customer onboarding is so important, if challenging, to get right.

Customer onboarding challenges

The traditional onboarding process is lengthy and can involve multiple departments within the bank: front office, risk management, compliance, legal, credit, and others. As a result, the onboarding process can take up to several weeks and lead to the customer’s frustration and dissatisfaction. It can be very detrimental as customer onboarding influences such vital metrics as client loyalty, referrals, and profitability.

Although banks make great efforts toward improving this process (including automation efforts), the results often still leave much to be desired, as several obstacles make customer onboarding initiatives ineffective.

1. A highly unstructured and lengthy process

Customer onboarding usually involves several departments in the organization, each having its own rules and procedures. Even for the most straightforward cases, with little financial and legal risk involved, it can take between 20 and 60 steps. This slows down the process and can be confusing to customers who might be required to provide the same information to different people several times. Digital or mobile onboarding can decrease the number of process steps but depends on back-end processes that remain manual and time-intensive.

Long onboarding timelines not only lead to high rates of account opening abandonment but also force financial institutions to forego some onboarding opportunities due to an inability to handle them effectively.

2. Abundance of regulations

The number of regulations that banks and other financial institutions must comply with is enormous, and they are becoming more complex, which makes regulatory compliance harder than ever. To make sure they stay at the top of their game, banks need to review and adjust their internal processes regularly, adapt internal systems, and communicate changes to customers promptly. Since 2018, more than 70% of the world’s $5.3 billion spent in financial crime enforcement actions were related to onboarding compliance lapses.

3. A large volume of documents to process

The onboarding process usually involves the management of 5 to 10 documents, but the number of documents can reach several dozen in more complex cases. The same documents can be processed several times by different departments at various stages of the process, creating confusion and leading to errors.

4. Many legacy systems are involved

Most banks still use old legacy systems, which makes it hard to provide customers with a smooth end-to-end experience and also creates problems for maintaining and updating the data across all systems. This problem can be partially solved by robotic process automation (RPA), but it is not a scalable solution — automation should involve not only the applications used but also document processing, regulations checks/updates and other challenges mentioned above. RPA cannot be effectively implemented to solve this; the process needs artificial intelligence.

New drivers for automating customer onboarding

The reasons why more banks are considering Intelligent Automation are not limited to the challenges mentioned above. Increasing revenue and cost implications of subpar client services create new drivers for implementing intelligent solutions for customer onboarding automation. They include:

- Increasing competition from emerging fintech companies. Many digital-native financial firms have experienced impressive customer growth lately. According to a recent Accenture survey on the future of global payments, traditional banks anticipate a 15% erosion of payments revenue to digital competitors.

- Changing customer expectations. Customers expect fast onboarding and subsequent service, which also needs to be highly personalized.

All these create a new feeling of urgency to develop intelligent automated customer service systems that are easy to deploy, scale and update. While RPA-focused solutions can effectively automate task-level rule-based operations, this level of transformation requires extensive use of artificial intelligence.

Benefits of customer onboarding automation

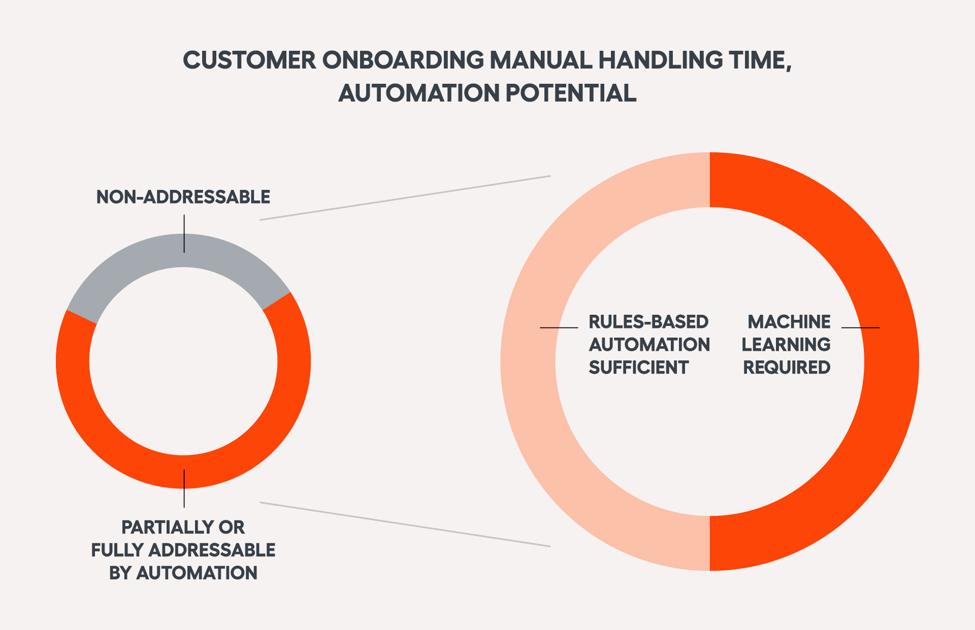

We estimate that more than 60% of manual work in the customer onboarding process in a bank can be partially or fully automated, and about half of the work reduction requires using machine learning, digitization, and analytics on top of RPA.

As a result of using Intelligent Automation for customer onboarding, the whole process can take minutes rather than days, which means the banks can successfully onboard more clients faster and don’t need to forgo new opportunities.

However, increased speed is not the only benefit of intelligent process automation that you can expect. Other benefits include:

- Improved regulatory compliance resulting in a significantly lower risk of fines.

- Enhanced customer experiences and higher customer satisfaction and customer retention rates.

- Increased accuracy of data processing removes the need to repeat the same steps during a process.

- Better analysis of the onboarding process helps to identify and get rid of bottlenecks that were unnoticed before.

In a time of slowing banking growth and emerging challenges, automating various operations in customer onboarding can help banks focus on other questions and stay competitive and profitable.

Automating customer onboarding operations helps banks to “crack the code” of building long-lasting relations with customers without wasting significant resources. This will help them navigate a large number of emerging business and technological challenges and therefore stay competitive during a time of slowing growth in the financial sector.