Adverse Media Monitoring, also known as Adverse Media Screening or Negative News Screening, is one of the most effective tools that banks and other financial institutions (FIs) have to protect their reputation and guard against money laundering and other financial crimes.

The goal of adverse media screening is to monitor and then review negative news about a person or company to determine if conducting business with them would incur a reputational risk or potential involvement with criminal activity. Whether from the news, international organizations, legal reporting, or other sources, adverse media monitoring allows FIs to determine customers’ intended account usage and context of transactions flows, and to evaluate a range of reputational considerations. Despite the critical importance of adverse media monitoring, it is expensive, time-consuming, prone to regulatory and audit criticism, and can be ineffective at achieving its core goal. An effective negative news solution can protect the brand, profitability, and stakeholder relationships of banks and other FIs.

The Old Approach No Longer Works

Traditional screening tools surface a vast number of news articles that end up being irrelevant, false positives that consume substantial amounts of analyst time — an unnecessary burden on employees and a large expense for the organization. Moreover, the cost of existing news screening tools can be staggeringly high. And that cost is only rising as FIs must account for increased regulatory pressure while taking on more complex customers that operate across multiple geographies and have many relationships, subsidiaries, and business names. In fact, the total projected cost of financial crime compliance for the U.S. and Canada is $56.7 billion. Add to that the billions of dollars in fines handed out in recent years, and FIs have plenty of incentive to find a truly effective Adverse Media Monitoring solution.

Traditional, outdated approaches to Adverse Media Monitoring:

- Manual Negative News Search: Analysts run searches in Google or a subscription database, read multiple articles and save relevant articles via print screen to create an audit trail to justify the decision to onboard a customer. They follow a written Operating Procedure but have full leeway in decision-making.

- Curated Content Services: Analysts send ad hoc or bulk requests to the provider software to run entities against their lists. The provider marks off suspicious names and sends them back to the bank for review.

- Boutique/Point Solutions: Analysts perform ad hoc or bulk searches using the provider software which flags suspicious results and may perform some risk prioritization.

- Systems Integrator Solutions: Analysts perform ad hoc or bulk searches using the provider software which flags suspicious names, creates an audit trail, and may prioritize news.

- Custom-built Solutions: Analysts use a custom-built system in conjunction with news sources and to flag suspicious names. This most often requires manual entry into the custom system.

Regulators Welcome AI to Strengthen Compliance

As FIs seek to upgrade their adverse media screening capabilities, regulators are continuing to encourage them to integrate innovative approaches into their processes. Federal banking agencies and the Treasury’s FinCEN have welcomed AI to strengthen compliance approaches to maximize utilization of banks’ BSA / AML compliance resources.

More recently, regulators and organizations that have been historically slow to embrace technology are now doing so. The Wolfsberg Group recently concluded that “technology remains a key enabler in the effectiveness of identifying financial crime risk through screening, more efficiently and on a real-time basis.”

In the European Union, its 6th Anti Money Laundering Directive, which was implemented in 2021, recommends companies perform enhanced due diligence processes for high-risk customers, which includes carrying out open source or adverse media/negative news searches. It also encourages automated adverse media screening to achieve this.

Regulators want to see FIs enhance their processes, opening the way for compliance teams to approve solutions like WorkFusion’s AI Agents that augment a compliance workforce towards maximum utility.

Using AI for Adverse Media Monitoring

Leading banks and other FIs are adopting a WorkFusion AI Agent that solves the compliance challenges of today — and more specifically, the adverse media screening challenges. Evan is WorkFusion’s AI Agent that is 100% AI-enabled and specializes in Adverse Media Monitoring for screening new customers and monitoring existing ones.

How Evan Works

Evan’s adverse media monitoring mission is to protect an organization from risky client relationships by reviewing both ad hoc adverse media results as well as alerts from adverse media screening applications. Compliance teams are deploying Evan in the cloud and/or on-premises with full automation capability to deliver adverse media screening in a 4-phase process:

- Retrieves articles in ad hoc searches and/or adverse media screening applications alerts

- Analyzes and prioritizes the retrieved news articles and/or alerts

- Decisions false positives in both ad hoc searches and adverse media screening alerts, with a hand off to another analyst where Evelyn cannot make final determination

- Generates and publishes detailed reports and audit trail

Each step in the workflow is accompanied by an audit trail — neatly put together by Evan. So, if, for example, an analyst wants to review a specific entity’s news articles which Evan has flagged, “he” has already included a source link, along with an archived copy of the article.

Because Evan is an AI worker, he never tires and continuously learns via machine learning (ML) to ensure ongoing, ever-higher rates of accuracy.

He can be up and running quickly. One bank recently deployed Evan on Google Cloud in just two weeks — two weeks! That’s pretty darn efficient when you’re talking about gaining a Digital Worker that has been shown to reduce manual review time for adverse media monitoring by more than 80 percent.

Stop the False Positives That Slow You Down

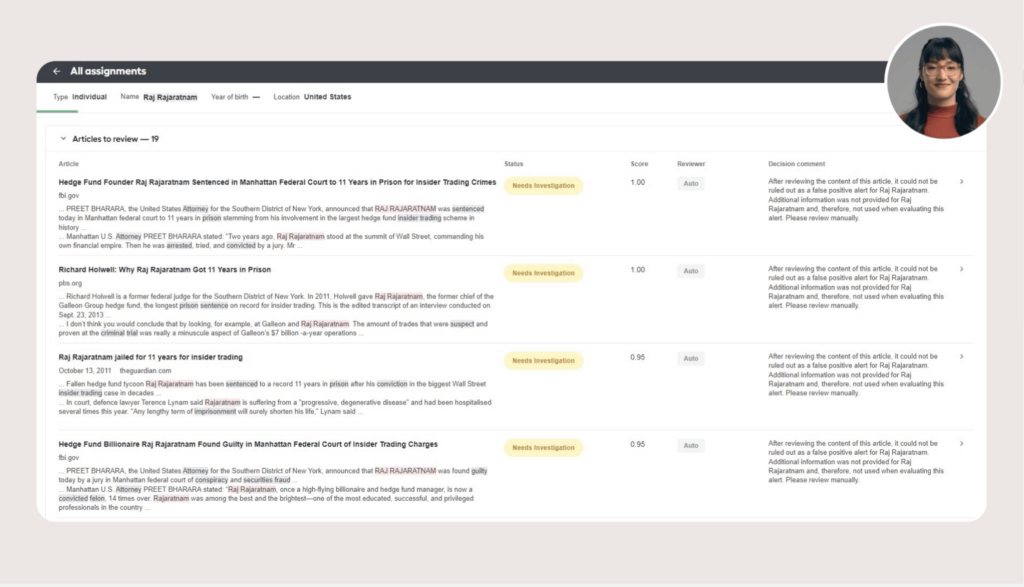

News articles are highly variable and a noisy data source. While traditional screening tools that rely on rules-based automations and NLP don’t go far enough, a smarter solution like WorkFusion’s AI Agent Evan dramatically speeds adverse media screening and relieves your workforce burden. As she does these things, Evan makes it easy for you to check her progress via an intuitive dashboard that shows process cycle times, volumes, SLA compliance, and many more metrics which analysts can inspect for detailed information (see the image below). This way, you can rest assured that the adverse media monitoring job is getting done — accurately, quickly, and efficiently.

Since all the data and analysis remains within the WorkFusion platform, reports can be easily generated, saving even more time for your compliance team. The impact grows when the time comes to prove your efforts to regulators. In a fraction of the traditional reporting time, your compliance leaders can generate reports to demonstrate your robust technology to scale AMM with growing demand.

WorkFusion Adverse Media Monitoring in Action

WorkFusion’s adverse media monitoring prowess is on full display at Scotiabank today. Despite having a traditional sanctions screening tool in place, Scotiabank’s compliance team adopted adverse media monitoring from WorkFusion. The results have been impressive:

- Freed up more than 100 full-time employees’ worth of labor

- Saved $4.2 million within the first 6 months

- Projected $15 million in annual cost savings

Additionally, a large, Florida-based community bank needed to identify and deploy a new AMM solution to screen new customers, and monitor existing ones, across a customer base that is both domestic and international. The cost of its existing news screening tool was staggeringly expensive and was only rising. And, its mixed customer geographic profile elevated its compliance risks and was driving the need for greater accuracy, consistency, and scale. The bank needed to do all of this without adding any additional headcount. The bank replaced its existing competitive news source with WorkFusion’s AI Sanctions and Adverse Media Screening Analyst Digital Worker, Evelyn, using its built-in Google News search function. There were immediate and significant results, including:

- Immediate 250k savings by replacing existing news source

- Projected $1.4M+ in OpEx cost by automating the work that would normally require 19 FTEs

- Volume spikes will not require additional FTEs or contractors

- Existing FTEs were able to handle higher-value work

Isn’t it time that your compliance team modernized your AMM to stay ahead of the regulatory and risk curves associated with AML compliance?

Check out Evan and the rest of the AI Agents at www.workfusion.com today.