A talent dilemma persists in the banking and financial services (BFS) industry.

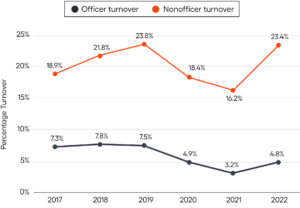

In their most recent Bank Compensation and Benefits Survey, Crowe revealed a steep increase in nonofficer employee turnover at banks, despite talent turnover remaining fairly flat at the officer level. The turnover rate for nonofficers jumped from 16.2% in 2021 to 23.4% in 2022. Crowe found this trend notable, saying, “This trend occurred despite the average salary for these [nonofficer] positions increasing by 5% in 2022.”

Among nonofficer employees in AML/BSA compliance and KYC operations, a recent LexisNexis® Risk Solutions study, The True Cost of Financial Crime Compliance, found that 6 out of 10 US and Canadian firms say they need more skilled compliance professionals to address their lack of FinCrime operations scale.

According to a media report by ACAMS, “Financial institutions must ensure that the AML/BSA function is appropriately staffed with the right expertise, authority, and resources.” ACAMS cited two specific consent orders issued by Federal Reserve Bank (FRB) regulators that ordered the banks to ensure that the compliance programs have adequate resources and expertise and that the banks “allocate adequate resources for the AML/BSA Compliance Officer and staff.” The Office of the Comptroller of the Currency (OCC) cited in an enforcement action against MidSouth Bank, N.A. that the bank had an “inadequate system of internal controls and a weak BSA staffing function” and ordered the board to ensure “the BSA Officer had sufficient executive authority, time, and resources to ensure BSA compliance.” In February 2018, the OCC assessed $528 million in fines and penalties against U.S. Bank for its failure to address “systemic deficiencies included the capping, or limiting, of suspicious activity alerts based on staffing considerations, which resulted in a significant amount of unreported suspicious activity.”

It’s clear that the current state of affairs in FinCrime compliance staffing can have dire consequences for all the financial institutions (FIs) – large and small – that fail to staff properly and maintain a robust capacity to analyze and act upon suspicious activity. For this reason, financial institutions must analyze their current staffing levels, anticipate the associated risks of potential employee departures, and put a plan in place to ensure proper AML/BSA/KYC compliance coverage.

Perform a staffing assessment

Understanding the staffing requirements to mitigate FinCrime risk is crucial to compliance program success. As ACAMS put it, “A lack of experienced and qualified staff may directly affect an institution’s ability to mitigate and manage the risks identified in risk assessment. Taking the time to conduct a proper staffing assessment and resource allocation, one based specifically on the risk of the institution, is vital to the success and strength of an AML/BSA and CTF (Countering the Financing of Terrorism) program.”

To perform a successful staffing assessment, an FI should follow a straightforward process that includes upfront risk assessments, policy and procedure updates, analysis of transaction volumes, staff turnover rates, and more. Remember to plan for future growth and/or expansion of regulations, such as the AML Act of 2020. When it comes to meeting with regulators, you must show them that you are sufficiently staffed with properly trained and experienced personnel as well as capable of handling your current and projected volumes of FinCrime alerts.

A Real-Life Staffing Assessment

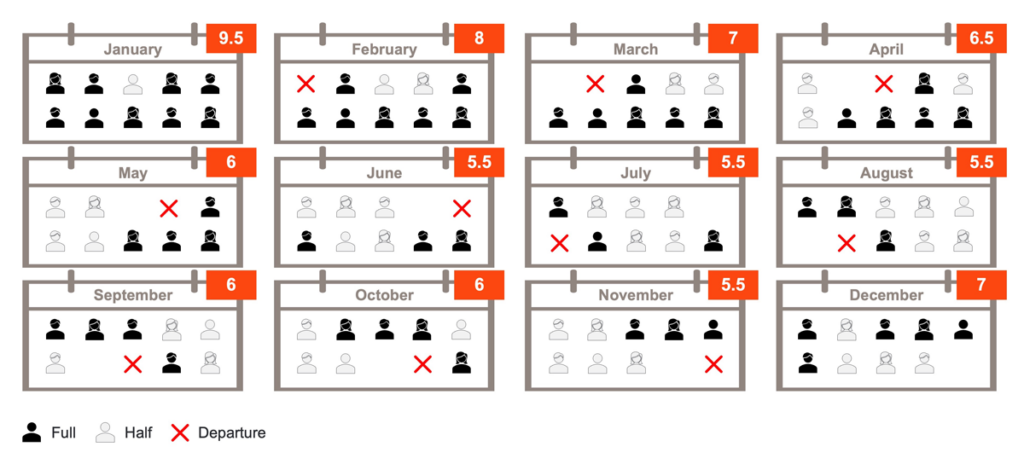

One of our current WorkFusion customers was experiencing 100% yearly turnovers of their L1 staff. The situation had grown so bad that senior employees (including the OFAC officer) were helping to handle L1 alerts. When they performed a staffing assessment, they considered the following critical data points:

- Vacation and personal/sick time off

- Attrition rate

- Time to hire, onboard, train, and upskill L1 analysts (5+ months in total)

Based on their data, the bank found that for every team of 10 people, the bank would be, on average short one person, and often more. Here’s how the assessed year would likely play out:

Clearly, this bank had a serious staffing issue that they needed to address immediately. Rather than doubling down on their traditional (and unsuccessful) method for attempting to boost L1 analyst capacity in line with their alert volumes, the bank decided to implement AI-driven Digital Workers to scale capacity rapidly.

Remember, it does not matter to regulators how you staff up to expertly handle FinCrime alerts, investigation, and adjudication – as long as you have assessed your needs and responded responsibly and accordingly. In fact, regulators are encouraging the use of technology to improve quality and scale in FinCrime compliance (see the AML Act of 2020, FinCEN’s Innovation Initiative, and the Wolfsberg Group’s statement on the use of AI in FinCrime compliance). At the same time, the OCC’s recent Semiannual Risk Perspective highlighted the difficulties banks face finding adequate numbers and quality of hires for compliance oversight.

Leverage AI-driven automation to fix the situation

AML/KYC compliance operations leaders should look holistically at the work that L1 analysts should really be doing. It should routinely involve high-value, complex tasks instead of the tasks that AI-based technology solutions can perform today. As an example, our AI Agent, Evelyn, can automate many of the time-consuming, error-prone tasks related to adverse news and sanctions alert reviews. Evelyn accurately reviews and dispositions false positive alerts at superhuman speed, allowing compliance teams to identify true potential risks faster and with greater accuracy.

AI Agents transform compliance work by not just incorporating rules for rote comparisons, but also by collecting data from additional internal and external sources, enabling requests for additional information direct from customers, and leveraging machine learning to train on all available data. In the end, a compliance program can reduce by 60–80% the volume of false positives identified by sanctions screening tools, reducing the level of manual effort by 50–70% and delivering substantial capacity growth.

As for attrition, AI Agents also contribute to relieving pain in that area. Among our customers, we routinely see the combination of AI and automation reducing attrition rates by approximately 50%. This longer-tenured staffing situation directly eases the burden on management, quality assurance, hiring, onboarding, and staffing – all significant factors to increased capacity.

To see how your organization can alleviate your FinCrime compliance staffing challenges by “hiring” AI Agents, click here to request a demo.