Banking and financial services (BFS) organizations are continuously adjusting to sanctions changes, but when sanctions changes appear in headlines, as it has with the conflict in Eastern Europe, the pressure of compliance becomes frantic. People on these teams don’t want to be the subject of a news feature for facilitating illegal transactions, yet many have already been fighting through a backlog of customer payments and are at risk of missing their SLAs.

How can banks and other financial organizations process payments faster, and ensure compliance while creating bandwidth so as not to burn out their workforce? As part of the WorkFusion Buzz webinar series, we introduced a solution: Tara, a digital transaction screening analyst, can review sanctions alerts quickly, freeing real-world teams to focus on understanding and adapting to change.

Automating sanctions alert reviews

Meet Tara, WorkFusion’s digital worker focused on the role of a transaction screening analyst. She is a top OFAC and AML expert who is laser-focused on keeping transactions risk-free and simplifying payment sanction screening alert reviews.

According to Tara’s job description, she reviews sanctions alerts in real time to protect organizations from processing payments from sanctioned organizations and individuals. This means she analyzes alerted payment messages (e.g., SWIFT) to decide whether an alert is valid or a false positive, narrating her explanation and escalating to a real-world colleague, if needed. In addition, she often consults third-party sources to research organizations and individuals to support her decision.

Why automated sanctions reviews are so important to payments

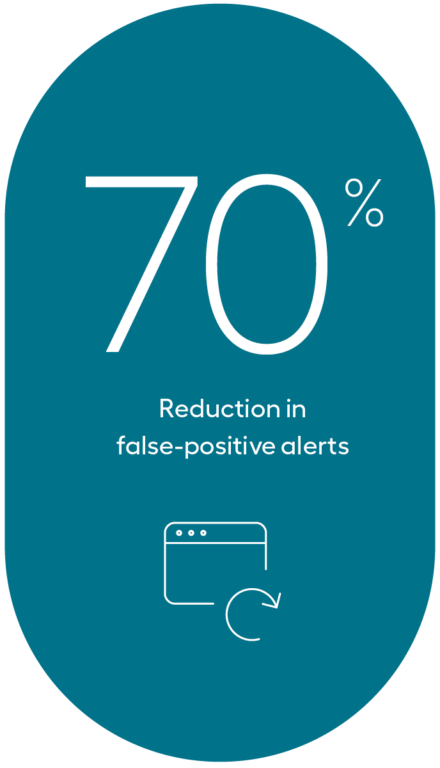

Tara’s work with payment sanction screening typically results in a reduction of over 70% of the false positives, vastly reducing the backlog of payments waiting on manual reviews. When a payment is stopped because of a need for review, this may create such a poor customer experience (CX) that the account holder may take their business elsewhere.

By automating entity recognition and name matching for individuals and organizations, while leveraging a decision matrix and historical decisions to process payments faster, Tara helps payments go through more quickly and reduces customer churn. Further, as AML teams can then exert less effort on manual reviews of alerts, they can focus on other needed areas of sanctions compliance.

Automation in action for sanctions compliance

Tara is already at work, streamlining payments for banks and other financial institutions (FIs). One neo bank hired Tara to remove a customer backlog of 1–2 business days, saving more than 120,000 hours per year. Tara also eliminated human error in the screening alert review process while increasing operational capacity by 2–3x for the FIU (Financial Intelligence Unit).

More efficient sanctions compliance for financial transactions

In a challenging sanctions environment, Tara simplifies the lives of analysts manually reviewing payment alerts. FIs are already putting her to work in expediting payments, while ensuring sanctions compliance and reducing customer attrition.

Learn more: