2023 proved to be quite the transitional year in BSA/AML compliance, as non-traditional finance companies faced more fines relative to traditional banks than ever before, while the US became recognized for outsizing the rest of the world in reports of Russian export controls evasion.

Following are the four stories of 2023 that our experts highlighted as having the greatest impact in the evolving realm of BSA/AML compliance.

- At $4.4 billion, Binance received the largest fines in FinCen and OFAC history.

- Crypto and fintech firms surpassed traditional banks in fine amounts for AML and sanctions violations in 2023.

- BSA data revealed the majority of reports on companies evading Russian export controls concern electronics-related operating within the United States.

- FinCEN issued a final rule implementing access and safeguard provisions of the Corporate Transparency Act.

#1. Binance receives the largest fines in FinCen and OFAC history

On November 21, 2023, Binance Holdings Ltd. pleaded guilty to US federal charges and admitted that it engaged in money laundering, unlicensed money transmitting, and sanctions violations. As a result, Binance also agreed to pay a settlement with FinCen of $3.4 billion and a settlement with OFAC of $968 million – for a total just shy of $4.4 billion. Binance Chief Executive Changpeng Zhao was forced to step down as part of the agreement.

Binance admitted that it willfully operated as an unregistered money services business (MSB) while obscuring its ties to the U.S. and maintained its most commercially important U.S. customers.

As an MSB, Binance was required to report suspicious transactions to FinCEN through suspicious activity reports (SARs). Binance never filed a single SAR with FinCEN and willfully failed to report over 100,000 suspicious transactions. US Treasury Secretary Janet Yellen summed up the case by stating that Binance chose to “prioritize growth over compliance with U.S. legal requirements.”

Binance admits that it willfully failed to establish, implement, and maintain an effective anti-money laundering program, particularly by failing to perform Know Your Customer (KYC) on a large number of its users. FinCEN’s investigation revealed that Binance also failed to mitigate the risks of anonymity-enhanced cryptocurrencies that allowed its users to obscure information about the origin and destination of transactions.

Read here for additional details:

https://home.treasury.gov/news/press-releases/jy1925

#2. Crypto and fintech firms surpassed traditional banks in fine amounts for AML and sanctions violations in 2023

At $5.8 billion in fines, crypto and fintech firms faced approximately six times more fines than did traditional banks for AML and sanctions violations in 2023. The data was revealed in this report by the Financial Times. Essentially, the firms were fined mostly for failing to have in place adequate AML and sanctions checks. It is important to note that the fines covered in the report relate only to AML and sanctions violations, helping industry players recognize the true scope of the problem.

In Yahoo Finance’s coverage of the story, reporter David Hollerith put forth the main drivers behind crypto and fintech’s poor performance in AML and sanctions compliance relative to traditional banks. “Many regulators practically live at the banks and they [banks] have much firmer controls in place. The banks….also have to follow much stricter laws such as the Bank Secrecy Act.” He also highlighted that, being young companies, many crypto and fintech firms have focused on growth over compliance.

Read the full Financial Times report and watch the Yahoo Finance video coverage at these links:

Crypto, fintech companies fined $5.8B in 2023: Report (yahoo.com)

#3. The majority of reports on evasion of Russian export controls concern electronics-related companies that operate within the United States

According to a September 2023 Financial Trend Analysis (FTA) report based on 333 SARs filed between June 28, 2022 and July 12, 2023, 96% of which were filed by U.S.-based depository institutions, there was nearly $1 billion in suspicious activity tied to evasion of Russian export controls. The FTA was based on a BSA dataset.

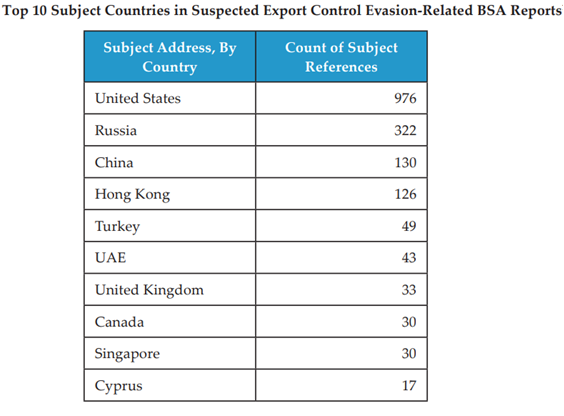

According to FinCen, the majority of companies identified in the BSA dataset look to be associated with—or directly facilitating—Russian export control evasion and are connected to the electronics industry. Many of the U.S.-based companies noted in the BSA reports manufacture or sell electronics equipment, such as microelectronic components, imaging technology, electronic filters, and electromechanical instrumentation. The BSA reports also showed that a growing number of companies were located in Hong Kong and maintained bank accounts in China, Hong Kong, and Russia. BSA filers identified their customers’ lines of business in many ways, such as reviews of account information, open-source research, and discovery of invoice information.

In addition to companies linked to the electronics industry, analysis of BSA data identified companies in the industrial machinery industry that were operating in China, Hong Kong, Singapore, the United States, and other countries.

Not only does the United States top the list of BSA report filings for export control evasion, the number of US-based subjects referenced in the filings outnumbered those of the next nine countries combined.

FinCEN welcomes feedback on this FTA report, particularly from financial institutions. You can submit feedback about the report to the FinCEN Regulatory Support Section at [email protected].

To access the FTA report, visit this link:

Financial Trend Analysis (FTA) report

#4. FinCen issued a final rule implementing access and safeguard provisions of the Corporate Transparency Act

On December 21, 2023, FinCEN issued a final rule implementing the access and safeguard provisions of the Corporate Transparency Act (CTA) (the “Access Rule”). The Access Rule prescribes the circumstances under which beneficial ownership information (BOI) reported to FinCEN may be disclosed to authorized BOI recipients, and how it must be protected. Protection around BOI is one of the industry’s main concerns with the CTA, among others which we noted in this fall 2023 blog post.

According to FinCen, “The final rule implements the BOI access and safeguard provisions in the CTA. The rule balances the statutory requirement to create a database of BOI that is highly useful to authorized BOI recipients, with the requirement to safeguard BOI from unauthorized use. This final rule reflects FinCEN’s understanding of the critical need for the highest standard of security and confidentiality protocols to maintain confidence in the U.S. Government’s ability to protect sensitive information while achieving the objective of the CTA.” The objective of the CTA, as stated by FinCen, is to establish a database of BOI that will be highly useful in combatting illicit finance and the abuse of shell and front companies by criminals, corrupt officials, and other bad actors.

To read the full details of the final rule, visit this page at the Federal Register:

Federal Register: Beneficial Ownership Information Access and Safeguards

So, that’s a wrap on the biggest stories of BSA/AML compliance in 2023. To stay ‘in the know’ throughout 2024, visit www.workfusion.com/blog to read our monthly BSA/AML compliance news roundups and other insightful analysis from our team of compliance experts.