Financial Institutions (FIs) of every shape and size, from global multinationals to regional banks, have felt the pain of what is being called the Great Resignation. But even before the pandemic, Customer Due Diligence (CDD) and other Know Your Customer (KYC) requirements were becoming an operational headache due to increasing labor costs and burdensome — and error-prone — manual processing.

How can banks and other FIs modernize their operations in an era where manual operations do not scale at the speed that the business demands? As part of the WorkFusion Buzz webinar series, we introduced a solution: Darryl, a digital CDD program analyst, who can reduce the burden on real world teams, unchaining business growth from manual operations.

Automating Customer Due Diligence

Meet Darryl, WorkFusion’s digital worker focused on the role of a CDD program analyst. Darryl has been trained at top financial institutions to protect the organization from risky client relationships by collecting information and documentation to conduct due diligence on customer relationships.

According to Darryl’s job description, he classifies due diligence documents, extracts key information, validates and updates data in a case management system, and uploads classed documents to document management systems for entities being onboarded or refreshed. This involves handling even the most complex documents, such as articles of incorporation, trust agreements, and ultimate beneficial ownership (UBO) forms. Darryl can capture full legal names, perform reconciliation, and detect signatures. He even works collaboratively with real-world colleagues, escalating exceptions via a human-in-the-loop capability.

Why automated CDD is so important to BFS

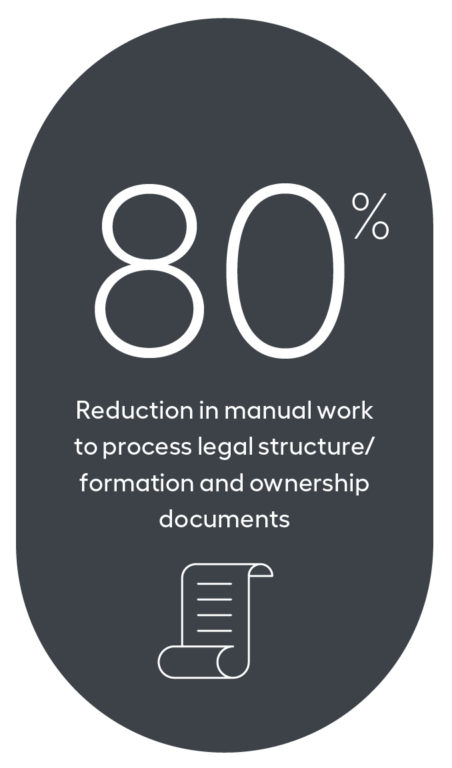

Darryl is able to work as part of KYC and compliance teams. He can capture and interpret ownership and legal structure information for customer onboarding, periodic reviews, and KYC refreshes — even help the team shift towards perpetual KYC. He essentially removes 80% of the manual work, simplifying CDD and the broader KYC effort.

Given documents and data on customers (often from email), he can understand specific details to compare and validate against systems of record and case-management tools, so real-world teams don’t have to do it. He’s integrated with PEGA but can work with any case-management tool.

In speaking with customers and prospects, they also rave about the positive impacts on team morale. With Darryl in place, they don’t have to spend their time trolling through those really unstructured long documents, identifying information and re-keying it into a system of record. Darryl can do it for them, allowing the team to focus on more revenue-generating complex tasks, which really increases their overall level of enjoyment at work.

On the other side of the coin is customer experience (CX), with increases to customer retention. As the CDD and KYC reviews are more accurate with almost zero reworking, onboarding times have decreased, customers can trade quicker, can start using products at those banks faster, and thus start gaining value — meaning Darryl is increasing customer satisfaction.

Automation in action for due diligence

Darryl is a Digital Worker already on the job, assisting financial institutions (FIs) to scale and grow their businesses. One large financial services firm experienced growth that was putting too much pressure on the compliance team. They needed to expand capacity but did not want to add headcount. By hiring Darryl, they are on a path to $800K ROI. By automating the processing of approximately 45,000 trust agreements and articles of incorporation each year, Darryl is removing 70% of processing time, improving the experience for their financial advisors. Darryl has doubled the team’s capacity, avoiding the need for increased headcount.

More efficient KYC

In a competitive banking environment, Darryl streamlines the work of analysts working due diligence requests manually. FIs are already putting him to work in expediting KYC processes, leading to positive impacts like more efficient customer onboarding, and producing happier customers overall.

Learn more:

- Watch WorkFusion Buzz S1:E4

- Read our pKYC: Avert the Alerts Avalanche white paper

- Additional resources about Darryl, Customer Due Diligence Program Analyst