Organizations often come to recognize their need to automate when employees say, in essence, “Please take this tedious work away from me. I am bogged down with this and bored.” And resistance, if any, to automation usually comes from senior managers who question, “What is the benefit (to me) of replacing our current processes?”

To build an automation program and deliver it well, we need to define its value. Let’s start by asking:

- Will automating this process add value?

- Will that generate revenue for the business?

- Will it save money, and/or employees’ time?

- Will this improve employee morale?

In answering these questions, a bank often comes to decide that its anti-money laundering (AML) program is a good place to start an automation journey. Let’s explore why.

About AML

Financial crime and money laundering are nagging problems for financial institutions. All financial services providers must follow the appropriate processes and controls to prevent bad actors from using their products and services to facilitate criminal activities. Unfortunately, there is an ever-growing difficulty for launching AML processes in terms of resources and costs, increased transaction volumes, and a high rate of false alerts from screening systems.

As money-laundering methods continue to evolve and become more sophisticated, so too should the methods to combat it. Intelligent Automation (IA) helps financial institutions win this fight.

How does AML benefit from automation?

Advanced AML platforms eliminate the complexity of managing disparate systems and multiple vendors. Machine learning and advanced automation can replace complex parts of the manual AML process and supply analytics related to money laundering, which allows banks to separate important risk warnings from false information. IA can perceive seemingly unrelated indicators of risk between payment platforms, geographic regions, depositors and recipients, and meaningfully relay these signals.

More points to consider:

- Investigation of suspicious transactions can be time-consuming and often yields unsuccessful results due to overly protective mechanisms.

- Machine learning can monitor complex patterns and report serious transactions for AML staff to investigate.

- IA reduces false positives when monitoring transactions, allowing compliance teams to focus on genuine threats.

In short, Intelligent Automation is not about fundamentally changing the approach to AML, but about rethinking and improving processes for existing elements such as transaction monitoring, risk assessment, and Know Your Customer (KYC). However, within these elements, its effects can be tangible. Now let’s review real success stories of WorkFusion customers who started their automation journey with AML.

Customers share their experiences

We asked a few of our customers why they started their automation program with an AML approach and received valuable insights.

Identify areas where there is a high opportunity [to benefit from automation]. Having information — the process cataloging work, process information, number of steps, overall complexity, number of applications involved, how many people you have deployed against those processes, the effort required to complete them successfully — allows you to own a targeted effort that can maximize the return.

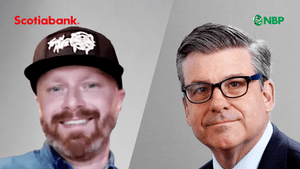

Why start with AML? Sehr Saghir, speaking from her experience with our customer Bank of Montreal, said several factors go into that decision — firstly, enthusiasm from leadership.

“AML leadership tends to be pioneers in finding new technologies that make processes more efficient. So having their buy-in and support, and hunger for new things and efforts to make their processes more efficient, that’s a good place to start.”

James Stubbs from the National Bank of Pakistan has been looking at technology opportunities for years. According to him, the purpose of AML (specifically, transaction monitoring and alert analysis) is to investigate scenarios. The industry recognizes that increasing headcount can lead to incredibly expensive operations. Plus, in addition to high costs, a lot of the work is unsatisfying — redundant and tiresome — and therefore lends itself well to automation.

The primary idea was to help people focus on evaluative work, allow them to exercise judgment, and do the things that really excite them. I think that’s part of the objective we have: both cutting costs and increasing employees’ satisfaction.

What’s most notable here is that the human factor in AML persists. The ultimate goal is to free up the firm’s analysts so they can focus on where they are most valuable: high-risk cases. Instead of automating the decision-making process, financial institutions are now looking to support analysts with increasingly powerful technology.

“I will admit, one of the motivations for this is that remediating or enhancing a program can sort of feel thankless at times. Part of what I wanted to do also was to motivate the Compliance staff and say: “Look, I want you to be thinking innovatively, and I’m willing to invest in an opportunity for you to demonstrate that innovative thinking: for you to use your imagination, for you to talk to vendors with smart people who are already thinking about this, to join user groups to leverage that thought process. I think it’s a win-win all the way around concerning enhancing employees’ satisfaction, too.”

Ivan Zasarsky, a Financial Crime Leader at PwC, shared his thoughts on why to start automation with AML.

We are seeing two aspects. One is around the customer experience, which ties closely into the customer lifecycle management approach to financial services. As organizations become very interconnected, and there’s a commonality of regulatory compliance factors in their different products and services, there’s a tremendous opportunity to get it right and improve the customer experience. From a compliance point of view, many activities have a cost factor to them. So, every program balances efficiencies and effectiveness, and things can improve. The process catalog and obligation registries are critical. In doing that, there’s a tremendous opportunity to remove a sizable component of operating expenses, but retain, and in many cases, increase the effectiveness of the overall program.

What to consider while automating AML

Some of the most important lessons for banks as they embark on the IA journey include:

Take a close look at the data foundation

IA can significantly improve the performance of AML processes. But data quality and completeness are critical issues, as the full benefits of IA solutions can only be realized with complete and high-quality information. For example, it is hard to create a complete customer profile or conduct an expert analysis without having a holistic customer view.

Manage risk

Regulators have strict requirements regarding the explainability, determinism, and clarity of AML models. Consequently, model management, validation, and documentation are paramount, and banks should clearly explain how new models work and be able to reproduce results with the same sets of inputs.

Integrate systems and processes to combat financial crime

Future approaches will combine AML, fraud, cybersecurity, and other risk-management functions into a centralized, unified environment with integrated data orchestration, analytics development, decision-making, case management, reporting and governance, and a comprehensive and fully resolved workflow between them.

Learn more

WorkFusion customers find a great deal of success in automating AML. Learn more about Intelligent Automation for AML here.