Author’s Note, May 2022:

Since this article was originally published, the landscape for financial institutions, and their KYC departments, has changed irrevocably. Considering geopolitical events and the almost-weekly torrent of new sanctions programs, it has never been more important for enterprises to have robust, flexible and scalable solutions which can manage constant, ever-increasing volumes of data. Across the industry, sanctions alert volumes have increased by 300%+ but resources have largely stayed static. This leads to rising backlogs, which leave more accounts frozen, and ultimately creates poor customer experiences. According to a recent survey by ESG Research, as 38% of companies finding it more difficult to attract employees compared to 12 months ago, we assert that implementing an AI-enabled digital workforce is the only practical means for success.

WorkFusion’s Digital Workforce, also introduced since publication, includes several key roles in the pKYC process. These AI-enabled, expert knowledge workers are Casey, Digital Customer Service Coordinator; Evelyn, Sanctions and Adverse Media Screening Analyst; Tara, Transaction Screening Analyst; Kendrick, Customer Identity Program Analyst; and Darryl, CDD Program Analyst. Hire any of these workers to deliver immediate value individually — or together, so they can transform the capacity and performance of your teams.

Life is full of issues that we know we should solve, big and small, lying just out of sight but not out of mind.

The emails sitting in your inbox, unread and ignored? You’ll find time tomorrow, maybe. The customer agreement on file that was sent back unsigned? Nobody will notice, probably. The client whose account doesn’t have an address or date of birth? Another day or two for follow-up can’t hurt.

Does this sound familiar? It’s understandable if it does. The KYC process in many banks and financial institutions follows a similar and, unfortunately, well-trodden path exposing organizations to unnecessary risks.

Many firms have gone so far as to digitally transform their compliance programs on the front end, yet then waste eye-watering sums of money in the back end, due to the inefficient manual work needed for operations.

This industry-wide struggle affects many banks’ performance. According to Kroll, 29% of senior decision-makers in financial services estimate that their compliance costs alone in 2020 were more than 5% of their firm’s overall revenues. Only 14% said compliance spending was lower than 1% of their firm’s, again, total revenues. That’s a massive investment for any business!

But there is good news: These issues, whether they stand-alone or in concert, can be solved. The answer is perpetual KYC (pKYC), also called “ongoing KYC” or “event-driven KYC.” This continuous approach collects current customer information, enables enriched risk profiling, and allows firms to precisely allocate resources. In short, pKYC redefines what’s possible within compliance.

But first, let’s look at some typical pain points clogging up operations and how banks can safeguard against them.

Challenge: Managing client outreach

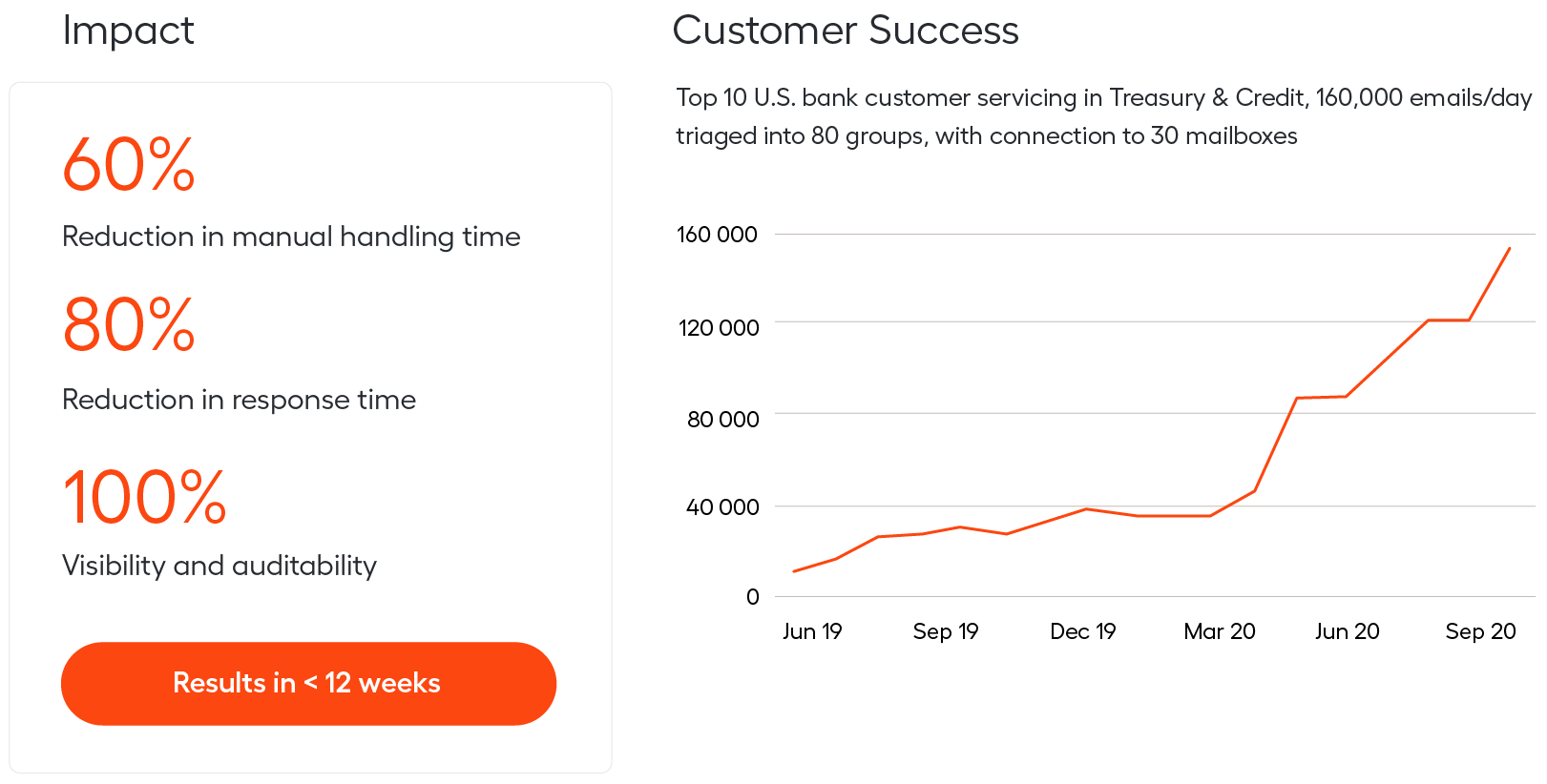

Email, email, email … all day long, analysts reach out to clients, monitor mailboxes, and review and categorize incoming/outgoing messages. This is inefficient for many reasons: Emails may be missed or sorted incorrectly, clients become aggravated from unwanted and repeated information requests, and employees grow frustrated because they’re acting as a glorified postal box. It’s a negative experience across the board, which correlates with a 15% revenue churn as customers seek better service.

Intelligent Automation streamlines triage and routing of emails in shared inboxes, escalating to teams and enabling workers to concentrate on customer service. The combination of tracking and machine learning optimizes email exchange by linking multiple emails and threads to a single case — ensuring that follow-ups are completed efficiently and information is dropped. Banks that ask KYC questions as a natural part of the digital journey, including follow-ups and reminders, tend to achieve high levels of customer satisfaction. Intelligent Automation can lead to a 25% reduction in customer touchpoints and 10% less customer churn.

You might like to learn more about Casey, our Digital Customer Service Coordinator, an email management expert already saving some of North America’s top banks millions annually.

Challenge: Document handling

Most organizations suffer under mountains of documents. In less metaphoric terms: An SVP of a major investment bank told me their analysts spent 250,000 dedicated hours per year attesting, handling, linking, and saving client documents. The dollar cost of this: $5–8 million annually!

Consider all the documents and data submitted by new customers as part of client onboarding. It’s enormous amounts of manual work to review and classify the documentation, upload each piece to the appropriate document store, extract key data points, and enter them into the system of record.

A single manual error by an analyst, such as a typo or a missed data point, can have material effects: The onboarding process can increase by 7–15 days, causing repeatedly missed SLAs. And this inefficiency is also expensive! Our analysis shows that compliance programs can cost anywhere upwards of $50 million for a mid-sized bank and larger banks easily spend more than $500 million annually.

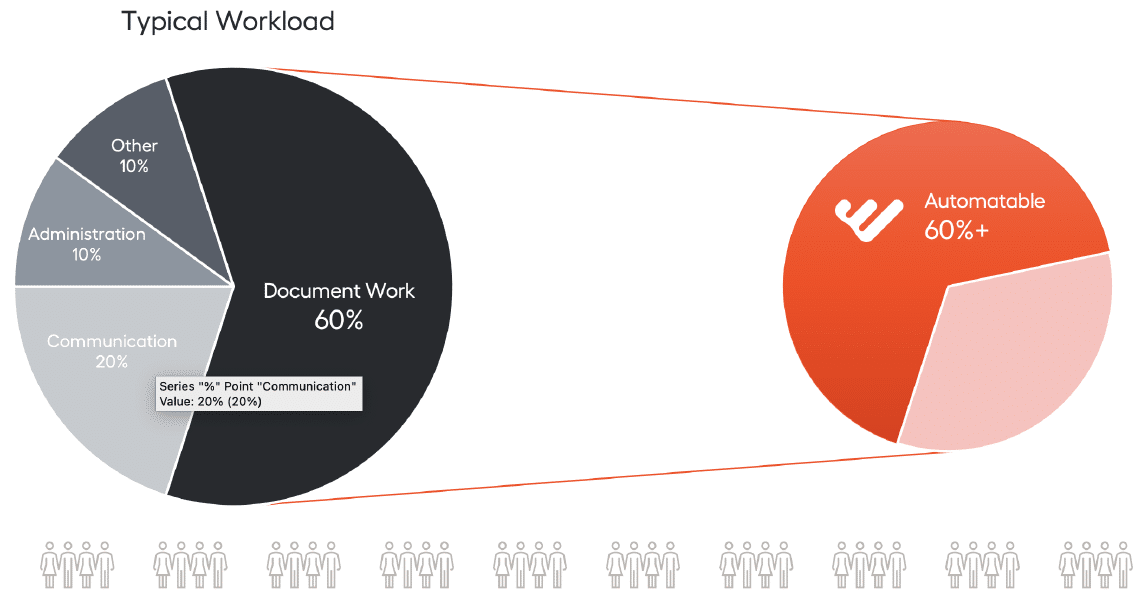

Roughly 60% of an employee’s day is spent processing documents, whether that’s structured documents, such as forms, or unstructured documents, such as LLC agreements. Using Intelligent Automation, and through machine learning technology that WorkFusion has live in the market today, that same 60% of their workload can be automated. This means that those line workers, who know your processes inside and out, can do more valuable revenue-generating work for your business.

Digital Workers including Kendrick, Customer Identity Program Analyst, and Darryl, Customer Due Diligence Program Analyst, can handle these tasks seamlessly and around the clock.

Relationship between satisfaction and success?

WorkFusion’s Kyle Hoback explores how more interesting and more creative tasks create more job satisfaction, and which is likely to result in more customer satisfaction, too — which leads to less attrition, less churn and is a win-win across the board.

Challenge: Overlooked risks due to poor data

Valuable time and effort are often spent collecting, consolidating, and cleaning data before it even is ready for risk assessment. Unwanted financial crime risks can be exposed without quality data sources to identify PEPs and sanctioned individuals. Inaccurate data entry, human error, and poor data quality are at the core of compliance issues that banks face daily. Failure to identify a sanctioned entity is serious and can lead to fines, regulatory enforcement, and reputational damage — remember Standard Chartered’s $657 million haircut in 2019?

Quality data should be at the center of a successful program; any focus on improving data quality and completeness will help in future projects. Looking at data points holistically improves the consistency of compliance checks and helps identify suspicious patterns. It will improve risk coverage, employee productivity, job satisfaction, and customer experience.

Digital Workers Evelyn, Sanctions and Adverse Media Screening Analyst, and Tara, Transaction Screening Analyst, have pre-built integrations to third-party data systems where they can seamlessly collect and reconcile data points, improving quality and managing overall risk.

Solution: pKYC

It would be one thing if all these issues existed in isolation, but we know that banks experience them all, all at the same time. Huge case volumes require global coordination, costs are very high, and the effects of manual approaches often generate poor customer experiences.

These critical deficiencies within a traditional KYC program can be very challenging and complex. That’s why perpetual KYC (pKYC) is revolutionary: This is a means of constantly collecting up-to-date customer information, enabling enriched risk profiling, and allowing firms to allocate resources only to those clients where data or circumstances necessitate attention. This totally reshapes the capacity of compliance efforts by improving communication and helping to implement risk-management controls that would otherwise be impractical or impossible.

In a pKYC approach, Intelligent Automation sits as a layer around your email, processing and validating information provided by customers in real-time, ensuring KYC requirements are completely and accurately fulfilled, and alerting analysts to any missing information. Software bots ingest, digitize, classify, and extract data from structured and unstructured documents, constantly fetching data attributes. Machine intelligence is layered into screening, to reduce false-positive alerts and mine billions of publicly available data points to ensure customer profiles are accurate and complete. All of these functions are integrated with core systems: seamlessly incorporating customer emails, processed documents, and sourced third-party data into the system of record; removing manual touchpoints; tying the respective items to specific policy requirements; and completing field-level data.

Most powerfully: This is all done on an uninterrupted, ongoing basis in the background as your analysts spend their valuable time on more thoughtful tasks, with their attention only required when the bots flag a material risk to the bank.

This innovation allows your teams to focus their efforts, reduces the manual caseload, and therefore shrinks costs overall. Customers don’t receive repetitive requests. Your risk profiling is superior. Operations teams are no longer overburdened. Banks implementing this technology will stay ahead of both competitors and bad actors, act proactively rather than reactively and are better protected against reputational risk.

The real power of this solution is in its orchestration. Implementing any individual Intelligent Automation solutions will help alleviate KYC challenges, certainly. However, the holistic value of implementing this tech in tandem far surpasses their separate contributions, not only saving your organization millions in costs but also allowing your enterprise to achieve true scale, with top-tier security. pKYC is the answer to the problems you know, and protection against the challenges yet to arrive.

If you’d like to learn more, I invite you to download our white paper on this topic or email me directly at [email protected] anytime.