To combat the skyrocketing cost and workloads associated with FinCrime compliance, the banking and financial services (BFS) industry is urgently seeking new and innovative ways to reduce cost, minimize risk, avoid fines and penalties, and lower employee burnout—all while scaling operations.

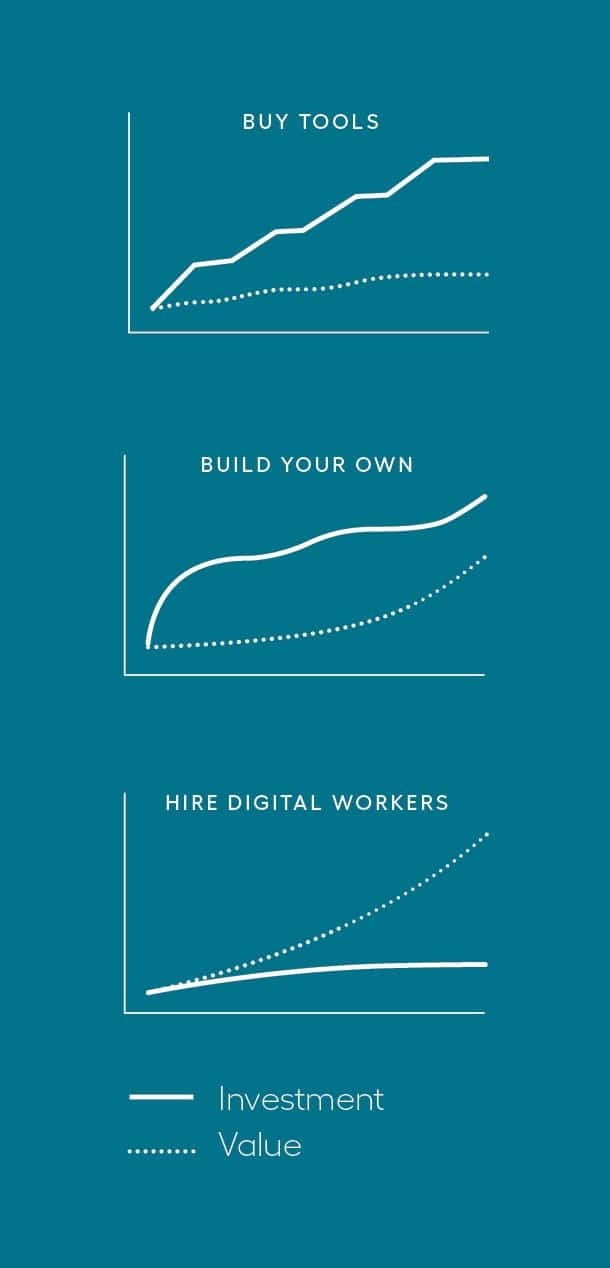

To achieve such a feat, a technologically advanced automation solution is no doubt needed. And so, the age-old enterprise IT question arises: do you build or buy a solution? There are pros and cons to both approaches, to be sure. But when you add the new technological frontier of AI into the mix, this age-old question becomes a new and more complex one: do you build, buy, or hire?

But what do we really mean when we say that you can hire a technology? After all, it’s not a person.

Read on as we explore all three scenarios below and describe what it means to “hire a technology.”

Build: High Risk, High Reward

Building your own bespoke automation solution may sound ideal. But bear in mind this sort of undertaking requires a hefty initial investment of time, money, and talent. While success is certainly possible, you can bet the time-to-value will be significant. Meanwhile, the clock keeps ticking for AML, KYC, and sanctions teams struggling to stay afloat.

It’s also important to note that venturing alone into the Wild West of AI can be treacherous. While regulators are encouraging its use (see the AML Act of 2020, FinCEN’s Innovation Initiative, and the Wolfsberg Group’s statement on the use of AI in FinCrime compliance), they’re also cracking down on doing so responsibly and explainably (see the Blueprint for an AI Bill of Rights in the U.S. and The AI Act in the EU). If you choose to build your own solution, you’re more or less on your own.

Buy: Low Risk, Low Reward

Incrementally buying and piecing together AI and automation tools a la carte may sound pragmatic. Maybe an RPA tool is complemented by OCR and IDP tools as needs arise and resources allow. It can feel safe and smart to tiptoe into a full-blown AI-centric approach to FinCrime. But, it’s inefficient.

Focusing one-by-one on solutions that are easy to pilot typically falls short of solving the big problems, limiting the possibility of accruing significant value. This approach also adds complexity. Each tool requires its own procurement process, launching and testing journeys, and integration with existing tools—not to mention separate analytics and reporting. Yes, each individual solution may stand on its own merits, but the conglomeration quickly becomes a monster to build, maintain, and control. In this continual “buy” scenario, teams achieve only small (if any) value over a multiyear timeline.

Hire: The Best of Both Worlds

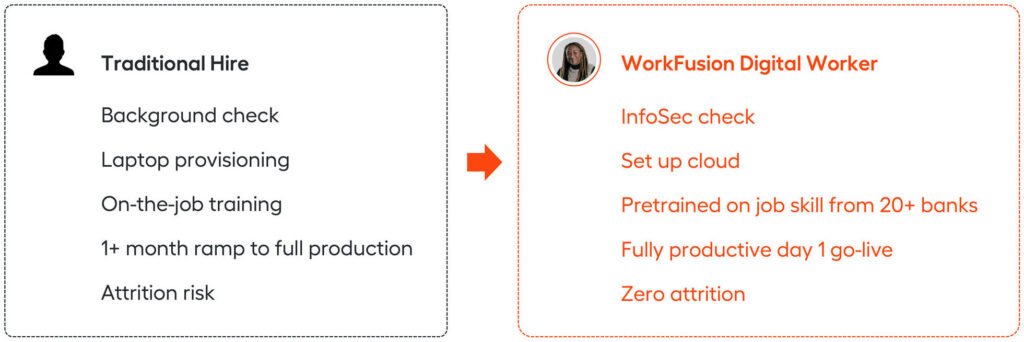

No, we don’t mean hire an army of L1 analysts to beef up your AML, KYC, and sanctions teams; Instead, “hire” AI Digital Workers: 100% digital analysts that are pre-built (and customizable) to solve specific FinCrime challenges like sanctions screening and adverse media monitoring.

Hiring AI Digital Workers represents a low risk, high reward option that avoids the cold-start problem of building or piecing together your own solution from scratch. Moreover, the performance of AI Digital Workers in the industry is already proven, and they deliver value almost immediately—in a matter of weeks from the time they’re “hired.”

Think of Digital Workers as the best of both worlds: like the “build” option, they’ve been pre-built as “bespoke” solutions for banking and financial services industries. Like the “buy” option, they’re pre-packaged as a single solution, but comprised of a comprehensive suite of capabilities that go way beyond RPA and include the following: artificial intelligence (AI), machine learning (ML), intelligent document processing (IDP), optical character recognition (OCR), and natural language processing (NLP).

When you hire WorkFusion AI Digital Workers, you’re not just buying a solution from a software vendor, but rather you’re establishing a partnership with us. We understand our BFS customers and their problems intimately (even first-hand in some cases), and we train our Digital Workers accordingly to solve those exact problems.

Want to hire a Digital Worker? It’s easier than you think. Schedule a demo with us today.